5 Takeaways From The Contract Development Manufacturing Organizations Market Overview 2024

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2024 and forecasted to 2033

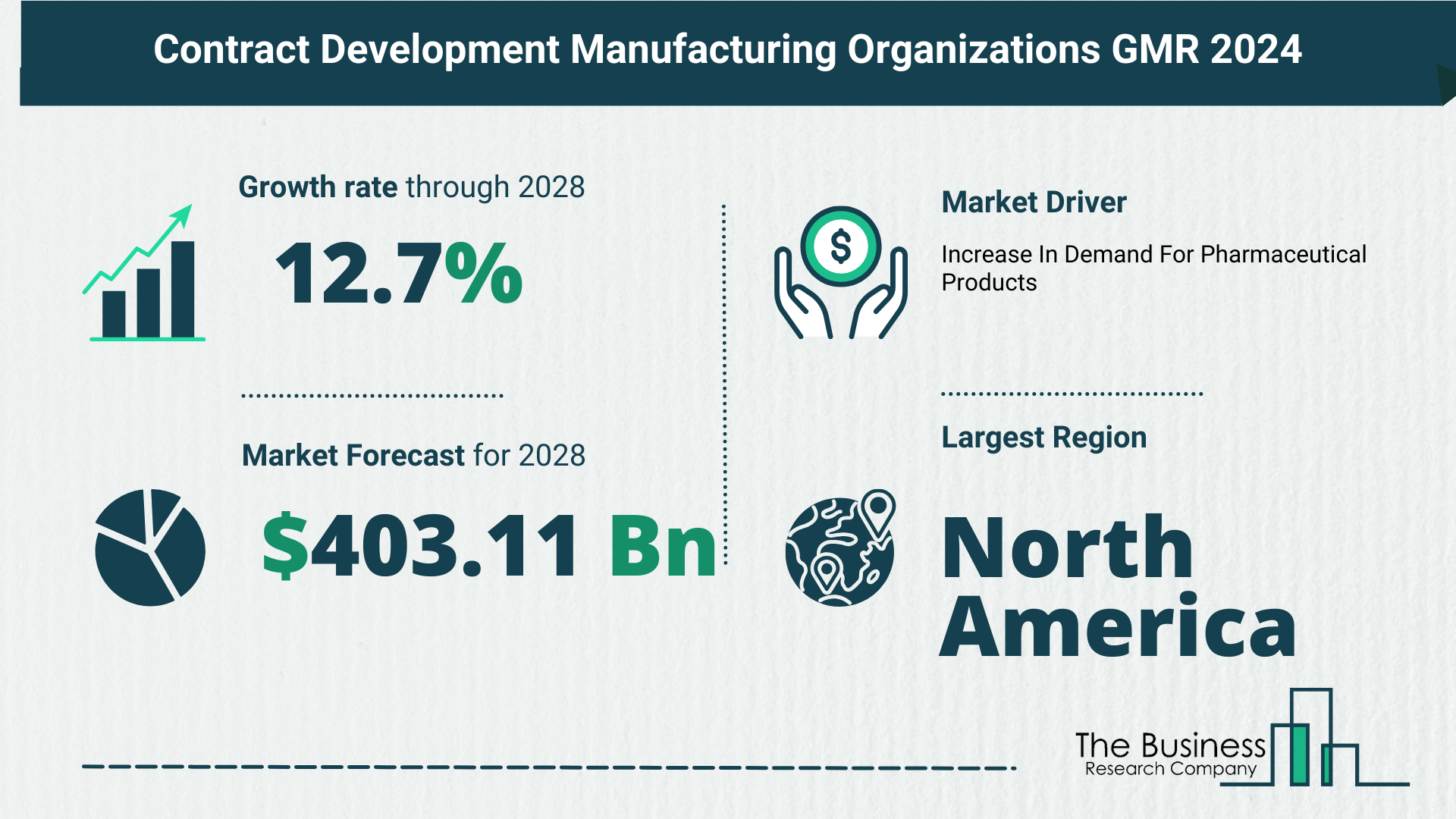

According to The Business Research Company’s Contract Development Manufacturing Organizations Global Market Report 2024, the contract development manufacturing organizations market is expected to show promising growth in the forecast period.

The contract development manufacturing organizations (CDMO) market has witnessed an exponential surge in recent years, with its market size escalating from $222.5 billion in 2023 to an estimated $249.96 billion in 2024. This upward trajectory is fueled by various factors, including the complexity and specialization in drug development, heightened demand for outsourcing in the pharmaceutical industry, cost containment pressures, advancements in biotechnology, and the globalization of pharmaceutical and biopharmaceutical industries.

Rapid Expansion on the Horizon

The growth projections for the CDMO market indicate a remarkable future. By 2028, the market size is anticipated to soar to $403.11 billion, boasting a compound annual growth rate (CAGR) of 12.7%. The forecasted surge can be attributed to the accelerated adoption of personalized medicine, an increasing demand for biologics and biosimilars, a heightened focus on research and development outsourcing, and regulatory changes impacting pharmaceutical manufacturing.

Trends Shaping the Future

The forecast period is marked by significant trends that are reshaping the landscape of contract development manufacturing organizations:

- Technological Advancements: Continuous improvement in manufacturing processes.

- Digital Integration: Incorporation of digital technologies in manufacturing processes.

- Sustainability: A shift towards environmentally friendly practices.

- Virtual and Decentralized Models: The rise of non-traditional CDMO approaches.

- Data Analytics: Growing importance of data analytics in optimizing manufacturing operations.

Clinical Trials as Catalysts

The escalating number of clinical trials plays a pivotal role in propelling the growth of the CDMO market. These trials, aimed at evaluating the safety and efficacy of new drugs or treatments in humans, present a lucrative avenue for CDMOs. The benefits include:

- Additional Revenue Stream: Engaging in clinical trials adds a supplementary income source.

- Long-Term Partnerships: Trials can lead to enduring partnerships with pharmaceutical companies.

- Enhanced Reputation: Successful trial involvement enhances a CDMO’s industry standing.

- Collaborative Relationships: Clinical trials facilitate the establishment of collaborative relationships.

As of May 2023, there are a staggering 452,604 registered clinical studies on ClinicalTrials.gov, with 64,838 actively seeking participants. This surge signifies a substantial increase from the 365,000 trials registered in 2021, underlining the market’s growth fueled by clinical trials.

Key Players Shaping the Landscape

Major companies driving the CDMO market include:

- Recipharm AB

- AbbVie Contract Manufacturing LLC

- Almac Group Limited

- Boehringer Ingelheim International GmbH

- Catalent Pharma Solutions Inc.

- Pfizer CentreOne

- Thermo Fisher Scientific Inc.

View More On The Contract Development Manufacturing Organizations Market Report 2024 – https://www.thebusinessresearchcompany.com/report/contract-development-manufacturing-organizations-global-market-report

Innovative Developments for Market Domination

Major CDMO players are not just riding the wave; they are actively shaping the market through innovative developments. An exemplary case is the introduction of Lifera, a commercial-scale CDMO launched by Saudi Arabia’s Public Investment Fund (PIF) in June 2023. Lifera focuses on producing vital biopharmaceutical goods, including insulin, vaccinations, monoclonal antibodies, plasma treatments, cell and gene therapies, and advanced small chemicals. The organization aims to increase local capacity and support domestic manufacturing through alliances with both domestic and foreign businesses.

Strategic Acquisitions Paving the Way

In February 2022, Recipharm AB made a strategic move by acquiring Arranta Bio, a US-based CDMO. This acquisition aimed to expand Recipharm’s capabilities in biologics, providing unique scientific offerings to innovative drug developers. It positioned Recipharm as a key player in new biologics modalities, ensuring diversification across various technologies and modalities.

Market Segmentation: Understanding the Dynamics

The CDMO market, as covered in this report, is segmented based on:

- Service: CMO, CRO

- Product: Small Molecules, Biologics

- End User: Big Pharma, Small and Mid-size Pharma, Generic Pharmaceutical Companies, Other End Users

Conclusion: North America Takes the Lead

In 2023, North America emerged as the largest region in the contract development manufacturing organizations market, underscoring the region’s dominance in this rapidly expanding sector. As the industry continues to evolve, these trends and developments are steering the CDMO market toward unprecedented growth, solidifying its crucial role in the pharmaceutical and biopharmaceutical landscape.

Request A Sample Of The Global Contract Development Manufacturing Organizations Market Report 2024:

https://www.thebusinessresearchcompany.com/sample_request?id=3885&type=smp