5 Takeaways From The Population Screening Market Overview 2024

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2024 and forecasted to 2033

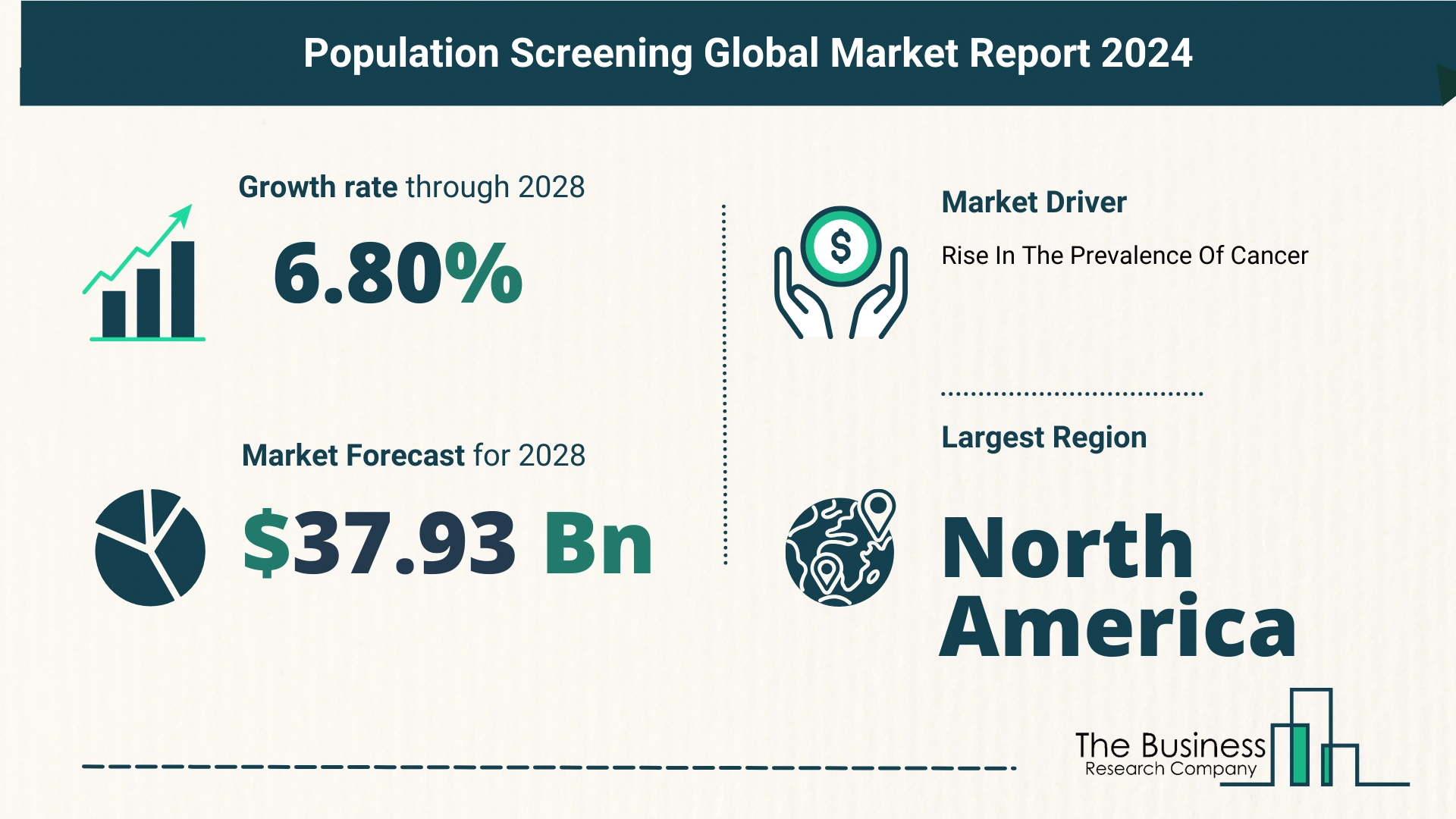

According to The Business Research Company’s Population Screening Global Market Report 2024, the population screening market is expected to show promising growth in the forecast period.

The population screening market has witnessed significant growth in recent years, with notable projections for the coming years. Here’s a snapshot of the market’s growth trajectory:

- In 2023, the market size stood at $27.02 billion.

- By 2024, it is set to reach $29.12 billion, marking a Compound Annual Growth Rate (CAGR) of 7.8%.

- Projections suggest further expansion to $37.93 billion by 2028, with a CAGR of 6.8%.

Factors Driving Growth

Several factors contribute to this growth:

- Disease prevention initiatives.

- Government health policies.

- Escalating healthcare costs.

- Increased disease awareness.

View More On The Population Screening Market Report 2024 – https://www.thebusinessresearchcompany.com/report/population-screening-global-market-report

The Surge Of Population Screening In Addressing The Growing Cancer Burden

Rising Prevalence of Cancer

Cancer remains a significant concern globally, driving the demand for population screening. Early detection is crucial for effective treatment and improved outcomes.

- The American Cancer Society projects nearly 1.96 million new cancer cases in the US by 2023.

- Population screening aids in detecting cancer early, enhancing treatment efficacy.

Key Players in the Market

Major companies shaping the population screening market include:

- Hoffmann-La Roche Ltd.

- Thermo Fisher Scientific Inc.

- Abbott Laboratories.

- Siemens Healthineers AG.

- Quest Diagnostics Incorporated.

The Technological Renaissance In Population Screening Markets

Embracing Technological Advancements

Technological innovation is a prominent trend driving market growth. Companies are leveraging cutting-edge technologies to enhance screening processes.

- Evoq Technologies LLC introduced SmartERG, a phone-based retinal health testing platform, in May 2021.

- This platform utilizes AI and machine learning to detect retinal diseases, offering enhanced patient care.

Illumina’s Strategic Acquisition

In August 2021, Illumina Inc. acquired GRAIL, reinforcing its position in cancer testing.

- GRAIL specializes in developing early cancer detection technologies.

- The acquisition broadens Illumina’s cancer testing portfolio, facilitating early intervention.

Segmentation and Regional Outlook

Diverse Market Segments

The population screening market is segmented based on various factors, including product, gender, age, and business:

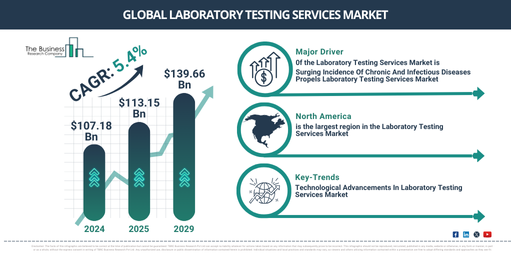

- Product segments include hardware equipment, testing or lab services, and analytics or interpretation.

- Gender segmentation covers both male and female populations.

- Age groups are categorized as less than 15, 15-65, and 65 and above.

- Business segments encompass hospitals, research institutes, and diagnostic labs.

Regional Dynamics

- North America dominated the population screening market in 2023.

- Asia-Pacific is poised to exhibit the fastest growth in the forecast period, driven by increasing healthcare investments and rising disease prevalence.

In conclusion, the population screening market is experiencing robust growth fueled by technological advancements, rising disease burden, and strategic initiatives by key players. As the market continues to evolve, embracing innovation and enhancing accessibility will be paramount for addressing global healthcare challenges effectively.

Request A Sample Of The Global Population Screening Market Report 2024:

https://www.thebusinessresearchcompany.com/sample_request?id=12587&type=smp