Top 5 Insights From The Dental Implants And Prosthetics Contract Manufacturing Market Report 2024

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2024 and forecasted to 2033

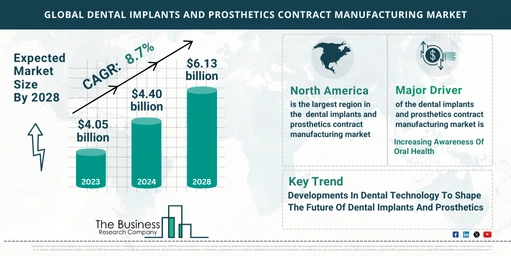

According to The Business Research Company’s Dental Implants And Prosthetics Contract Manufacturing Global Market Report 2024, the dental implants and prosthetics contract manufacturing market is expected to show promising growth in the forecast period.

- Market Expansion: The dental implants and prosthetics contract manufacturing market has experienced robust growth in recent years.

- In 2023, the market size reached $4.05 billion.

- It is expected to grow to $4.40 billion in 2024, reflecting a compound annual growth rate (CAGR) of 8.5%.

- Contributing Factors:

- Aging population.

- Rising disposable income.

- Increased awareness and education about oral health.

- Enhanced insurance coverage.

- Growth in dental clinics.

Future Market Projections and Drivers

- Continued Growth: The market is projected to maintain its strong growth trajectory.

- Expected to reach $6.13 billion by 2028 with a CAGR of 8.7%.

- Key Growth Drivers:

- Emerging markets expanding access to dental care.

- Increasing prevalence of dental disorders.

- Improved implant success rates boosting patient confidence.

- Growing patient preference for aesthetic dental solutions.

- Customization and personalized dental solutions becoming more prevalent.

View More On The Dental Implants And Prosthetics Contract Manufacturing Market Report 2024 – https://www.thebusinessresearchcompany.com/report/dental-implants-and-prosthetics-contract-manufacturing-global-market-report

Major Trends Shaping the Future

- Digital Dentistry:

- Increased adoption of digital impressions and 3D printing.

- Technological innovations driving efficiency and precision in dental care.

- Technological Advancements:

- Enhanced materials and production techniques.

- The use of AI in dental implant planning and design.

- Collaborations and Partnerships:

- Companies are joining forces to innovate and expand their market reach.

Growing Awareness of Oral Health as a Market Driver

- Oral Health Awareness:

- The rise in public health campaigns has increased awareness about oral health.

- Access to dental care is improving globally.

- Digital media has played a significant role in spreading information about preventive care and early detection.

- Impact on Market:

- Growing awareness leads to increased demand for high-quality, customized dental solutions.

- Example: In 2021, US national dental expenditures rose by 11% to $162 billion.

- As awareness grows, the dental implants and prosthetics contract manufacturing market is expected to flourish.

Technological Innovations Leading the Way

- Focus on Innovation:

- Major companies are investing in new dental technologies like NanoFusion to stay competitive.

- Case Study – SprintRay Inc.:

- In October 2022, SprintRay launched OnX Tough, a hybrid ceramic resin for 3D printing dental applications.

- This product is part of their digital solutions suite, designed to streamline dental workflows.

Strategic Acquisitions to Strengthen Market Position

- Elos Medtech’s Acquisition:

- In December 2023, Elos Medtech acquired Klingel Holding GmbH.

- This acquisition strengthens Elos Medtech’s position as a leader in the contract development and manufacturing organization (CDMO) market for medical devices.

- Klingel specializes in the assembly of mechanical medical components, including titanium dental implants.

Market Segmentation

- Product Type:

- Dental Implants.

- Dental Prosthetics.

- Materials:

- Porcelain Fused Metal (PFM).

- All-ceramics.

- Other Materials.

- End-Users:

- Dental Clinics.

- Ambulatory Surgical Centers.

- Dental Laboratories.

Regional Insights

- North America Leading the Market:

- In 2023, North America was the largest region in the dental implants and prosthetics contract manufacturing market, driven by advanced healthcare infrastructure and high demand for dental care services.

Request A Sample Of The Global Dental Implants And Prosthetics Contract Manufacturing Market Report 2024:

https://www.thebusinessresearchcompany.com/sample_request?id=15785&type=smp