5 Key Insights On The Medical Device Tray Market 2024

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2024 and forecasted to 2033

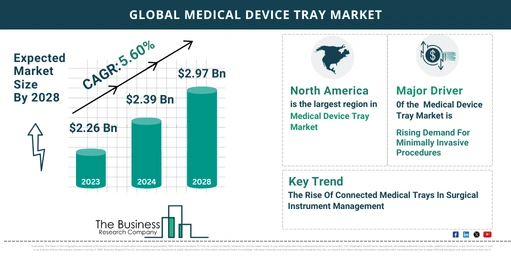

As per The Business Research Company’s Medical Device Tray Global Market Report 2023, the medical device tray market is expected to show significant growth in the forecast period.

Market Overview

- 2023 Market Size: $2.26 billion.

- 2024 Forecast: Expected to grow to $2.39 billion.

- CAGR: 5.5% from 2023 to 2024.

Key Drivers of Growth

- Advancements in Medical Technology: Continuous improvements enhance the functionality and efficiency of medical device trays.

- Regulatory Standards and Compliance: Strict guidelines ensure safety and efficacy in medical device use.

- Increased Surgical Procedures: Higher volumes of surgeries drive demand for medical device trays.

- Growth in Healthcare Infrastructure: Expanding healthcare facilities require more medical device trays.

- Focus on Infection Control: Emphasis on sterilization and hygiene boosts the need for specialized trays.

View More On The Medical Device Tray Market Report 2024 –

https://www.thebusinessresearchcompany.com/report/medical-device-tray-global-market-report

Future Market Projections

- 2028 Market Size: Expected to reach $2.97 billion.

- CAGR: 5.6% from 2024 to 2028.

Drivers for Future Growth

- Rising Aging Population: Increased healthcare needs drive demand for medical device trays.

- Technological Advancements: Innovations in tray materials and design enhance functionality.

- Rising Prevalence of Chronic Diseases: More chronic conditions lead to more surgical interventions.

- Increase in Surgical Procedures: Higher surgery rates create more demand for trays.

- Stringent Sterilization Standards: Enhanced standards for sterilization and infection control increase the need for effective tray solutions.

Trends Shaping the Market

- Demand for Sterilization and Infection Control: Increased focus on preventing infections drives the need for effective sterilization solutions.

- Advancements in Tray Materials: New materials improve durability and functionality.

- Customization and Personalization: Tailored solutions meet specific needs of various medical procedures.

- Integration of Smart Technologies: Smart trays with sensors and communication devices improve management and tracking of surgical instruments.

- Expansion in Outpatient and Ambulatory Surgical Centers: Growth in these settings drives demand for versatile medical device trays.

Rising Demand for Minimally Invasive Procedures

- Minimally Invasive Procedures: These procedures require specialized trays for organizing and sterilizing instruments.

- Advantages: Reduced recovery times, lower risk of complications, and less post-operative pain compared to traditional surgeries.

- Impact: Increased adoption of minimally invasive procedures drives the demand for specialized medical device trays.

- Example: In January 2024, Intuitive Surgical Inc. placed 415 da Vinci surgical systems, marking a 12% increase from 2022, highlighting the growing preference for minimally invasive approaches.

Major Companies in the Market

- Key Players:

- Cardinal Health, Johnson & Johnson, Thermo Fisher Scientific Inc., Abbott Laboratories, 3M Company.

- Medtronic PLC, Fresenius Medical Care AG & Co. KGaA, Becton Dickinson and Company (BD), Stryker Corporation.

- Henry Schein Inc., Medline Industries, Inc., B. Braun Melsungen AG, Zimmer Biomet Holdings, Inc., Olympus Corporation.

- Smith & Nephew plc, Hologic Inc., Nipro Corporation, Cook Medical, Getinge AB, Teleflex Incorporated.

- KARL STORZ SE & Co. KG, Mölnlycke Health Care AB, Integra Life Sciences, ConMed Corporation, Smiths Medical.

Innovations in Medical Device Trays

- Connected Medical Trays: Technologically advanced trays equipped with sensors and communication devices for real-time tracking.

- Example: In February 2024, Intech Medical launched Trackinbox, a customizable tray with smart tracking solutions to monitor location, usage, and sterilization status.

Strategic Acquisitions

- HealthpointCapital & SteriCUBE Holdings Acquisition (April 2024):

- Acquisition: HealthpointCapital acquired a majority stake in SteriCUBE Holdings.

- Objective: Expand into innovative medical technologies aligned with musculoskeletal healthcare.

- Impact: Enhances HealthpointCapital’s portfolio and market presence in the medical device tray sector.

Market Segmentation

- By Product Type:

- Categories: Sterilization Trays, Procedure Trays.

- By Application:

- Types: Surgical Trays, Diagnostic Trays, Dental Trays.

- By End User:

- Sectors: Hospitals and Clinics, Ambulatory Centers, Dental Clinics, Surgical Centers.

Geographic Insights

- Largest Region: North America was the largest market in 2023.

- Fastest-Growing Region: Asia-Pacific is expected to experience the fastest growth in the forecast period.

The medical device tray market is experiencing robust growth driven by increasing demand for minimally invasive procedures, advancements in technology, and rising surgical procedures. Innovations and strategic acquisitions are expected to further fuel market expansion in the coming years.

Request A Sample Of The Global Medical Device Tray Market Report 2024:

https://www.thebusinessresearchcompany.com/sample_request?id=16730&type=smp

The Medical Device Tray Global Market Report 2024 provides an in-depth analysis on the medical device tray market size, trends and drivers, opportunities, strategies, and companies analysis. The countries covered in the medical device tray market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, the UK, and the USA, and the major seven regions are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, the Middle East, and Africa.