Key Trends and Insights into the Preclinical Assets Market: Growth Rate and Opportunities to 2034

Updated 2025 Market Reports Released: Trends, Forecasts to 2034 – Early Purchase Your Competitive Edge Today!

How has the preclinical assets market grown over the years?

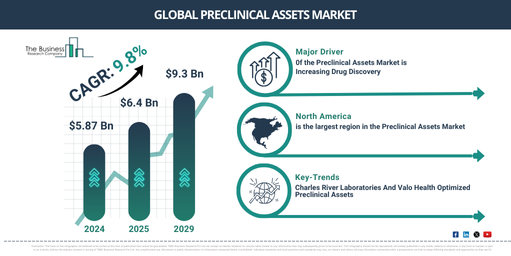

In recent years, there has been robust growth in the market size for preclinical assets. This market is projected to expand from $5.87 billion in 2024 to $6.4 billion in 2025, boasting a Compound Annual Growth Rate (CAGR) of 9.1%. This historical growth trend can be linked to several factors such as demands for drug development, advancements in biotechnology, regulatory obligations, the expansion of research funding, and joint research initiatives.

What Is the forecasted market size and growth rate for the preclinical assets market?

The projected growth of the preclinical assets market is robust, with estimates suggesting it will reach $9.3 billion by 2029, expanding at a compound annual growth rate (CAGR) of 9.8%. Various factors are driving this growth within the forecast period, such as advancements in precision medicine and tailored therapies, integration of artificial intelligence and machine learning, expansion of biobanking, a focus on rare diseases, as well as government initiatives and funding. Within this growth period, several trends are expected to emerge including advanced imaging techniques, 3D organoid models, integration of multi-omics, improved predictive models, along with automation and high throughput screening.

Get your preclinical assets market report here!

https://www.thebusinessresearchcompany.com/report/preclinical-assets-global-market-report

What are the major factors driving growth in the preclinical assets market?

The escalation in drug discovery is projected to drive the expansion of the preclinical asset market in the future. Drug discovery involves identifying chemical compounds that have potential to be used as therapeutic agents. This is the method by which new potential drugs are identified. Preclinical assets are critical to this process as they provide the necessary information and proof to assist in choosing molecules for clinical development. For example, the European Federation of Pharmaceutical Industries and Associations (EFPIA), a Belgium-based group representing the pharmaceutical industry, reported in June 2023 that the European pharmaceutical industry saw significant production growth, increasing from $352.48 billion in 2021 to $369.95 billion in 2022. Hence, the growth of the preclinical assets market is being fueled by the surge in drug discovery.

What key areas define the segmentation of the global preclinical assets Market?

The preclinical assets market covered in this report is segmented –

1) By Service: Bioanalysis And DMPK (Drug Metabolism And Pharmacokinetic) Studies, Toxicology Testing, Compound Management, Safety Pharmacology, Other Services

2) By Model Type: Patient Derived Organoid (PDO) Model, Patient Derived Xenograft Model

3) By End User: Biopharmaceutical Companies, Government Institutes, Other End-Users

Subsegments:

1) By Bioanalysis And DMPK (Drug Metabolism And Pharmacokinetic) Studies: Pharmacokinetics (PK) Studies, Pharmacodynamics (PD) Studies, Bioanalytical Method Development

2) By Toxicology Testing: Acute Toxicity Testing, Chronic Toxicity Testing, Genotoxicity Testing, Carcinogenicity Testing

3) By Compound Management: Compound Library Management, Sample Storage And Retrieval, High-Throughput Screening Support

4) By Safety Pharmacology: Cardiovascular Safety Assessments, Neurotoxicity Evaluations, Respiratory Safety Evaluations

5) By Other Services: Regulatory Support, Preclinical Study Design And Consulting, Custom Assay Development

Get your free sample now – explore exclusive market insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=12600&type=smp

What are the top market players propelling the growth of the preclinical assets industry?

Major companies operating in the preclinical assets market include Laboratory Corporation of America, IQVIA Inc., ICON PLC, Eurofins Scientific SE, PPD Inc., SGS SA, WuXi AppTec Co. Ltd., Intertrek Group PLC, Charles River Laboratories International Inc., Medpace Inc., Pharmaron Beijing Co. Ltd., Evotec SE, GenScript Biotech Corporation, Inotiv Inc., SRI International Inc., Shanghai Medicilon Inc., Biocytogen Pharmaceuticals Beijing Co. Ltd., AmplifyBio LLC, BioReliance Corporation, Pharmalegacy Laboratories Co. Ltd., Precigen Inc., ReproCELL Incorporated, InSphero AG, Crown Bioscience Inc., Comparative Biosciences Inc., TCG Lifesciences Pvt. Ltd., InVivo Biosystems, Pharmatest Services Ltd, Domainex Limited, Viroclinics Xplore

What are the key trends shaping the future of the preclinical assets market?

The trend towards product innovation is gaining traction in the preclinical assets sector. Key players in this market space are honing in on creating new products and solutions to solidify their market standing and secure a competitive edge. For example, in April 2022, Charles River Laboratories International, a US corporation specializing in preclinical and clinical laboratories, alongside Valo Health Inc., a technology company with a mission to revolutionize drug discovery, unveiled Logica, a drug solution powered by artificial intelligence (AI). Logica turns the biological insights of clients into refined preclinical assets, employing the superior preclinical acumen of Charles River and the AI-enabled Opal Computational Platform of Valo. This allows clients to transform their drug discovery processes through a comprehensive, integrated service that seamlessly converts targets into candidate nominations. In this collaboration with Valo, Charles River intertwines its lab expertise with molecular design technology, igniting a revolution in the industry to provide clients with highly-qualified leads and candidates, all while linking the client’s cost directly to value generation.

Unlock exclusive market insights – purchase your research report now for a swift delivery!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=12600

What regions are dominating the preclinical assets market growth?

North America was the largest region in the preclinical assets market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the preclinical assets market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Browse Through More Similar Reports By The Business Research Company:

Asset-Backed Securities Global Market Report 2024

https://www.thebusinessresearchcompany.com/report/asset-backed-securities-global-market-report

Preclinical Imaging Global Market Report 2024

https://www.thebusinessresearchcompany.com/report/preclinical-imaging-global-market-report

Defense IT Spending Global Market Report 2024

https://www.thebusinessresearchcompany.com/report/defense-it-spending-global-market-report

About The Business Research Company:

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead in the game.

Contact us at:

The Business Research Company: https://www.thebusinessresearchcompany.com/

Americas +1 3156230293

Asia +44 2071930708

Europe +44 2071930708

Email us at [email protected]

Follow us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

Found this article helpful? Share it on: