Overview Of The Ambulatory Surgery Center Market 2024-2033: Growth And Major Players Analysis

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2024 and forecasted to 2033

Introduction

The ambulatory surgery center (ASC) market has witnessed substantial growth in recent years and is poised for continued expansion. Key factors contributing to this trend include favorable reimbursement policies, a supportive regulatory environment, and advances in medical technology. Let’s delve into the current market size, forecasted growth, and major trends driving this dynamic sector.

Current Market Size and Growth

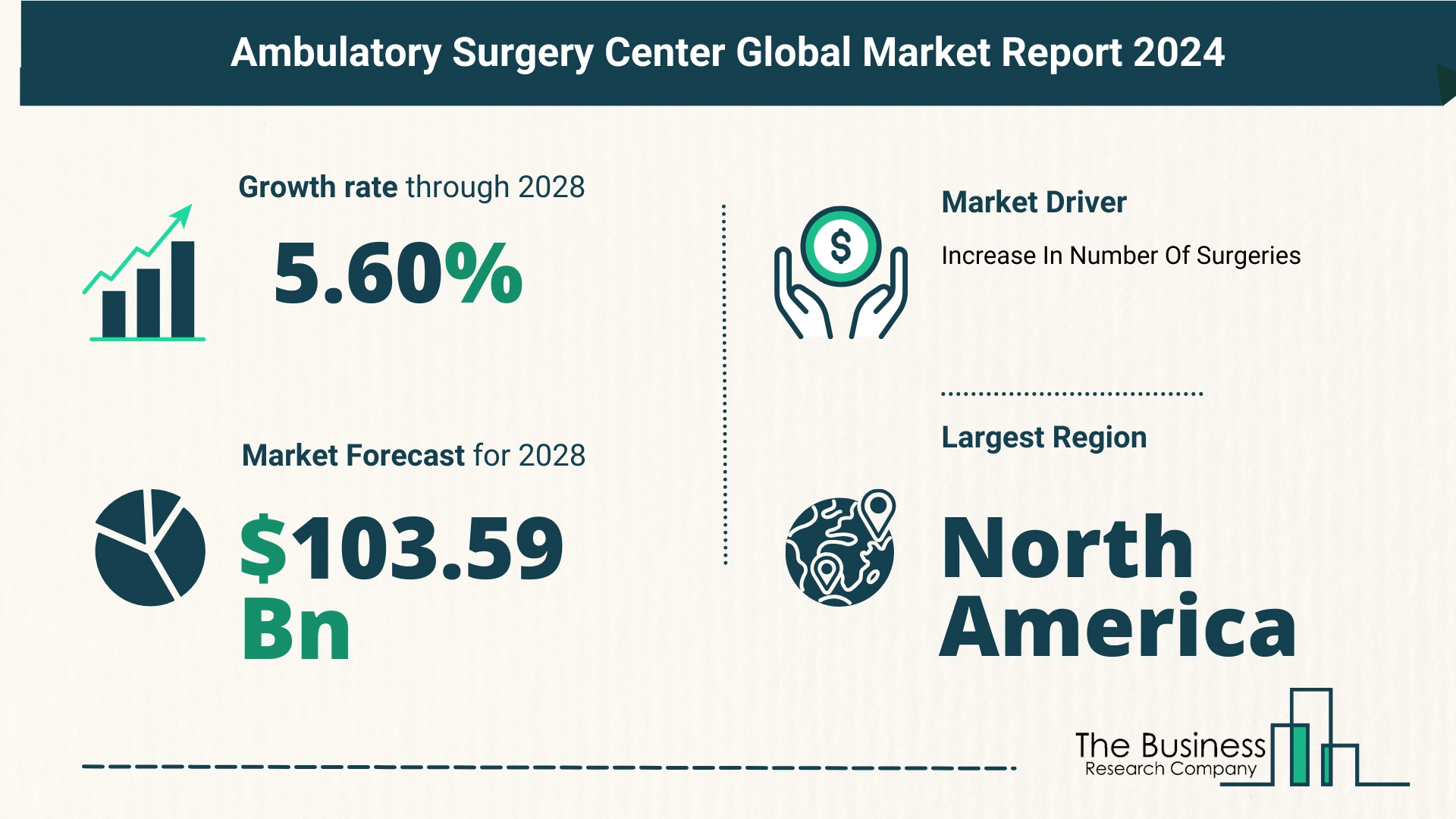

- 2023 Market Size: $78.03 billion

- 2024 Market Size: $83.84 billion

- CAGR (2023-2024): 6.8%

Factors Driving Historic Growth

- Reimbursement Policies: Streamlined processes and favorable reimbursement have encouraged the use of ASCs.

- Regulatory Environment: Supportive regulations have facilitated easier establishment and operation of ASCs.

- Patient Demand: The convenience and efficiency of outpatient procedures have boosted patient preference for ASCs.

- Advances in Anesthesia: Improved anesthesia techniques have made outpatient surgeries safer and more effective.

- Market Competition: Increased competition has driven improvements in service quality and cost efficiency.

Forecasted Market Growth

- 2028 Market Size: $103.59 billion

- CAGR (2024-2028): 5.6%

Factors Driving Future Growth

- Global Health Events: Preparedness for global health challenges is increasing the reliance on flexible, efficient care models like ASCs.

- Collaboration with Health Systems: Partnerships with larger health systems are enhancing the capabilities and reach of ASCs.

- Telemedicine Integration: The incorporation of telemedicine is improving patient access and care coordination.

- Chronic Disease Management: A focus on managing chronic diseases is driving the demand for specialized outpatient procedures.

- Population Health Management: Emphasis on population health is encouraging the adoption of cost-effective care solutions.

View More On The Ambulatory Surgery Center Market Report 2024 – https://www.thebusinessresearchcompany.com/report/ambulatory-surgery-center-global-market-report

Key Market Trends

- Digital Documentation and EHR Optimization: Improved electronic health record (EHR) systems are enhancing patient care and operational efficiency.

- Technological Infrastructure: Investments in cutting-edge technology are boosting the capabilities of ASCs.

- Advancements in Medical Technology: Innovations in medical devices and procedures are expanding the range of services offered by ASCs.

- Digital Health Integration: The integration of digital health solutions is streamlining operations and improving patient outcomes.

- Remote Patient Monitoring: The use of remote monitoring technologies is enhancing post-operative care and patient satisfaction.

- Collaboration with Health Systems: Strategic collaborations are helping ASCs provide more comprehensive care.

Surge in Surgical Procedures

The increasing number of surgeries performed globally is a significant driver of ASC market growth.

Key Points

- Outpatient Surgical Treatments: ASCs provide cost-effective, specialized treatment with faster recovery times.

- Rising Surgical Demand: In 2022, approximately 14.9 million surgical and 18.8 million non-surgical treatments were performed globally, marking an 11.2% increase.

Major Companies in the ASC Market

- McKesson Corporation

- HCA Healthcare

- Medtronic PLC

- Tenet Healthcare

- Philips Healthcare

- GE HealthCare Technologies Inc.

- Cerner Corporation

- Zimmer Biomet

- Optum Inc.

- Epic Systems Corporation

- United Surgical Partners International

- Surgery Partners

- SCA Health

- Athenahealth Inc.

Advancements in Electronic Health Records (EHR)

Technological advancements in EHR systems are revolutionizing patient care and operational efficiency in ASCs.

Example

- eClinicalWorks: Launched EHR software version V12 in October 2023, offering enhanced performance, improved usability, and advanced drug management displays.

Strategic Acquisitions

Strategic acquisitions are strengthening the presence of key players in the ASC market.

Example

- SurgNet Health Partners Inc.: Acquired Executive Ambulatory Surgery Center and Lippy Surgery Center in October 2023, enhancing its market presence and service offerings.

Market Segmentation

The ASC market can be segmented by:

- Components: Services, Software, Hardware

- Center Type: Single Specialty Centers, Multispecialty Centers

- Modality: Hospital-Based, Freestanding

- Application: Orthopedics, Pain Management, Gastroenterology, Ophthalmology, Plastic Surgery, Otolaryngology, Obstetrics/Gynecology, Dental, Podiatry, Other Applications

Regional Insights

- Largest Region (2023): North America

- Fastest Growing Region (Forecast): Asia-Pacific

Conclusion

The ambulatory surgery center market is experiencing robust growth driven by technological advancements, increasing surgical demand, and strategic collaborations. With a promising future outlook, ASCs are set to play an increasingly vital role in the healthcare landscape.

Request A Sample Of The Global Ambulatory Surgery Center Market Report 2024:

https://www.thebusinessresearchcompany.com/sample_request?id=13782&type=smp