Angioplasty Balloons Market Report 2024: Market Size, Drivers, And Trends

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2024 and forecasted to 2033

Market Overview

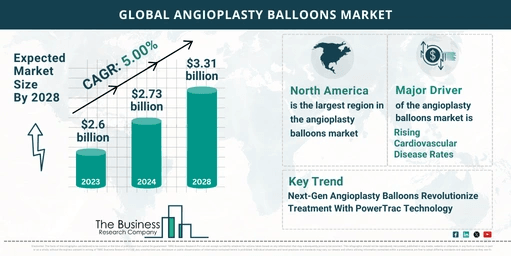

The angioplasty balloons market has exhibited consistent growth in recent years. The market size grew from $2.6 billion in 2023 to $2.73 billion in 2024, marking a compound annual growth rate (CAGR) of 4.9%. This growth is driven by several factors including increased clinical trials, decreased regulatory hurdles, more physician training programs, broader reimbursement coverage, and enhanced patient awareness and education.

Looking ahead, the market is projected to reach $3.31 billion by 2028, with a CAGR of 5%. This forecasted growth is supported by an aging population, rising prevalence of cardiovascular diseases, expanding healthcare infrastructure in emerging markets, greater adoption of minimally invasive procedures, and increased demand for interventional cardiology.

View More On The Angioplasty Balloons Market Report 2024 – https://www.thebusinessresearchcompany.com/report/angioplasty-balloons-global-market-report

Factors Driving Market Growth

- Rising Cardiovascular Disease Rates

- Prevalence Increase:Cardiovascular diseases are on the rise due to sedentary lifestyles, unhealthy diets, obesity, and aging populations.

- Treatment Needs:Angioplasty balloons are crucial for widening narrowed or blocked blood vessels to restore blood flow and reduce complications like heart attacks or strokes.

- Statistics:According to the CDC, coronary heart disease in U.S. adults increased slightly from 4.6% in 2020 to 4.9% in 2021, highlighting a growing need for angioplasty interventions.

- Technological Advancements

- PowerTrac Technology:Companies are developing advanced angioplasty balloons with PowerTrac technology to enhance tracking and pushability through complex vessel anatomies.

- Notable Launch:In July 2021, Medtronic introduced the Prevail drug-coated balloon (DCB) catheter in Europe, which uses PowerTrac technology to provide superior deliverability and pushability. This technology also allows for effective treatment of various vascular conditions without the need for permanent implants.

- Strategic Acquisitions

- Johnson & Johnson and Abiomed Inc.:In December 2022, Johnson & Johnson acquired Abiomed for $16.6 billion. This acquisition aims to expand J&J’s medtech portfolio and advance heart recovery solutions. Abiomed’s SupraCor Balloon Catheter is used in angioplasty procedures and adds significant value to J&J’s offerings.

Market Segmentation

- By Product Type:

- Normal Balloons

- Scoring Balloons

- Drug-Eluting Balloons

- Cutting Balloons

- By Material:

- Non-Compliant

- Semi-Compliant

- By Application:

- Coronary Angioplasty

- Peripheral Angioplasty

- By End User:

- Hospitals

- Specialty Clinics

- Catheterization Laboratories

- Ambulatory Surgical Centers

- Other End Users

Regional Insights

- North America:The largest market in 2023, driven by advanced healthcare infrastructure and high adoption rates of angioplasty procedures.

- Asia-Pacific:Expected to be the fastest-growing region during the forecast period, due to increasing healthcare investments, rising prevalence of cardiovascular diseases, and growing demand for advanced medical technologies.

Conclusion

The angioplasty balloons market is set to experience steady growth, fueled by advancements in technology, rising cardiovascular disease rates, and strategic industry moves. As the market evolves, the focus on innovative treatment approaches and expanding healthcare access will drive further developments and opportunities within the industry.

Request A Sample Of The Global Angioplasty Balloons Market Report 2024:

https://www.thebusinessresearchcompany.com/sample_request?id=15509&type=smp