Key Factors Fueling the Growth of the Blood Screening Market in 2025: Blood Screening Market Thrives Amid Rising Infectious Disease Prevalence

Discover trends, market shifts, and competitive outlooks for the blood screening industry through 2025-2034 with The Business Research Company’s reliable data and in-depth research

What Are the Projected Market Size and Growth Rates for the Blood Screening Market From 2025 To 2029?

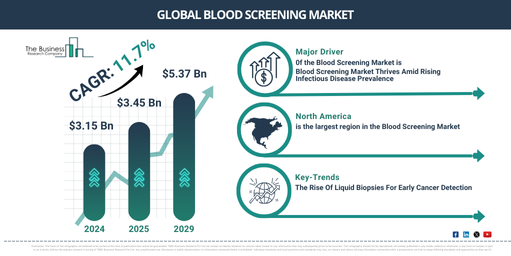

The size of the blood screening market has seen robust growth in the past few years. It is projected to increase from a value of $3.15 billion in 2024 to $3.45 billion in 2025, with a compound annual growth rate (CAGR) of 9.6%. This growth in the historical period is due to factors such as a rise in the requirements for blood transfusion, an increasing occurrence of communicable diseases, government rules and standards, an increment in blood donations and collections, and worldwide health concerns and epidemics.

The impending years are likely to witness a swift expansion in the blood screening market size, with an anticipated steeping to $5.37 billion in 2029, at a compound annual growth rate (CAGR) of 11.7%. The surging growth during the stipulated period can be justified due to numerous factors including the evolution of healthcare infrastructure, public health enlightenment agenda, innovative progress in infectious disease detection, factors of global health, and readiness for pandemics. The major trend-setters during this phase could be an increase in infectious diseases, enhancements in automation and operational efficiency, escalating needs for blood transfusions, emphasis on the safety of these transfusions, and investigations in the realm of pathogen detection.

Download a free sample to assess the report’s scope and structure:

https://www.thebusinessresearchcompany.com/sample.aspx?id=9047&type=smp

What are the Fundamental Drivers and Innovations Shaping the Blood Screening Market?

The surge in infectious diseases prevalence is anticipated to fuel the blood screening market’s expansion in the future. Blood analysis is frequently used to detect illness symptoms by identifying a specific antibody produced against the infectious organism. This primary information significantly aids physicians in effectively treating infectious diseases and preventing further spread of infection from patient to patient. For example, the National Center for Biotechnology Information, a United States government agency, reported in June 2022 that the prevalence of infectious diseases in outpatient care had nearly tripled over two decades, rising from 8 to 26 per 1,000. Consequently, the rising incidence of infectious diseases is propelling the growth of the blood screening market.

How Is the Blood Screening Market Segmented?

The blood screening market covered in this report is segmented –

1) By Product: Reagents And Kits, Instruments, Software And Services

2) By Technology: Nucleic Acid Testing, Enzyme-Linked Immunosorbent Assay (ELISA), Rapid Tests, Western Blot Assays, Next-Generation Sequencing (NGS)

3) By End User: Blood Banks, Diagnostic Centers And Pathology Labs, Hospitals, Clinics, Ambulatory Surgical Centers (ASCs)

Subsegments:

1) By Reagents And Kits: Diagnostic Reagents, Testing Kits

2) By Instruments: Automated Analyzers, Manual Testing Equipment

3) By Software And Services: Laboratory Information Management Systems (LIMS), Data Analysis Software, Support And Consulting Services

Request customized data on this market:

https://www.thebusinessresearchcompany.com/customise?id=9047&type=smp

Which Regions Are Driving the Next Phase of the Blood Screening Market Growth?

North America was the largest region in the blood screening market in 2024. The regions covered in the blood screening market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

What Key Trends Are Shaping the Future of the Blood Screening Market?

Key players in the blood screening industry are innovating with technologies like liquid biopsy to advance early cancer detection, optimize treatment tracking, and facilitate individualized treatment strategies. Liquid biopsy refers to a simple, non-invasive test that examines blood or other body fluids for signs of cancer cells or signs of genetic changes in tumors. For example, in November 2023, Guardant Health, Inc., a reputable biotechnology firm based in the United States, unveiled their Shield blood-based screening examinations. These tests study the cell-free DNA (cfDNA) circulating in the blood, which can signal the presence of colorectal tumors or pre-cancerous growths. They specifically target changes in DNA fragments that cancer cells emit into the blood.

View the full report here:

https://www.thebusinessresearchcompany.com/report/blood-screening-global-market-report

How Is the Blood Screening Market Defined and What Are Its Core Parameters?

Blood screening refers to a method of screening blood, plasma, or blood components for transfusion or use in blood products. It is used to screen for antibodies or tumor markers, to seek for disease-causing substances or symptoms, or to evaluate treatment effectiveness.

Purchase the full report and get a swift delivery:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=9047

About The Business Research Company:

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead in the game.

Get in touch with us:

The Business Research Company: https://www.thebusinessresearchcompany.com/

Americas +1 3156230293

Asia +44 2071930708

Europe +44 2071930708

Email us at info@tbrc.info

Follow us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model