5 Takeaways From The Cardiovascular Monitoring And Diagnostic Devices And Equipment Market Overview 2024 | Medtronic PLC, Boston Scientific Corporation, GE Healthcare, Johnson & Johnson, Philips Healthcare, Siemens Healthcar

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2023 and forecasted to 2032

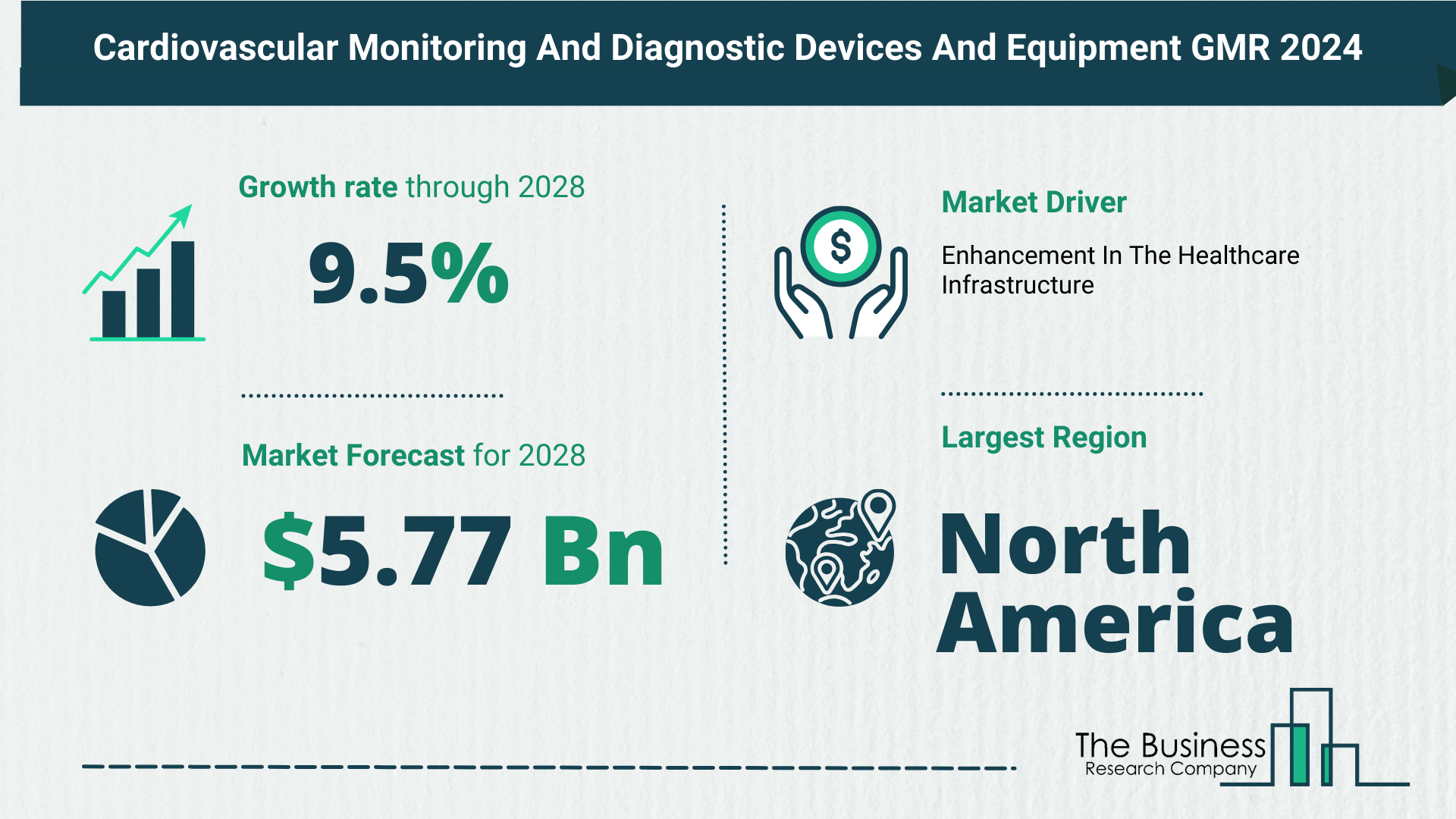

According to The Business Research Company’s Cardiovascular Monitoring And Diagnostic Devices And Equipment Global Market Report 2023, the cardiovascular monitoring and diagnostic devices and equipment market is expected to show promising growth in the forecast period.

The cardiovascular monitoring and diagnostic devices and equipment market have experienced rapid growth, escalating from $3.59 billion in 2023 to $4.01 billion in 2024 at a remarkable CAGR of 11.4%. The driving forces in the historic period encompassed the prevalence of cardiovascular diseases, an aging population, the emphasis on preventive healthcare, and the integration of telemedicine.

Anticipated Growth

In the upcoming years, the market is poised for robust expansion, projecting a growth to $5.77 billion in 2028 with a CAGR of 9.5%. The growth in the forecast period is attributed to factors such as personalized medicine, the rise of digital health, chronic disease management, and the surge in remote patient monitoring. Key trends in this forecast period include the adoption of wearable and mobile monitoring, AI-enhanced diagnostics, point-of-care testing, and remote cardiac rehabilitation.

Catalysts for Growth: Obesity and Diabetes

Prevalence of Risk Factors

The cardiovascular monitoring and diagnostic devices and equipment market find strong impetus from the increasing prevalence of obesity and diabetes. These conditions carry risk factors such as high blood pressure and high cholesterol, which are directly associated with cardiovascular diseases. According to the American Heart Association (AMA), it is estimated that by 2030, 22.2 million cases of cardiovascular diseases will emerge. Additionally, a study by the AMA in the U.S. reveals that 26 million people have been diagnosed with diabetes, with an additional 9 million yet to be diagnosed.

Market Players

Leading companies contributing to the growth of this sector include Medtronic PLC, Boston Scientific Corporation, GE Healthcare, Johnson & Johnson, Philips Healthcare, Siemens Healthcare, and others. These major players play a pivotal role in developing innovative solutions for cardiovascular monitoring and diagnostics.

View More On The Cardiovascular Monitoring And Diagnostic Devices And Equipment Market Report 2023 – https://www.thebusinessresearchcompany.com/report/cardiovascular-monitoring-and-diagnostic-devices-and-equipment-global-market-report

Driving Advancements: Product Launches

Embracing New Technologies

A key trend gaining momentum in the cardiovascular monitoring and diagnostic devices and equipment market is the launch of innovative products. Companies are strategically focusing on introducing new products to enhance their portfolios and solidify their market positions. For example, SmartCardia SA, a Swiss medical equipment manufacturer, unveiled the 7L patch in India in August 2022. This 7-lead cardiac monitoring patch combines wearable technology with AI, providing predictive and personalized patient insights through remote monitoring. The patch’s real-time arrhythmia event detection showcases the industry’s commitment to technological advancement.

Regulatory Framework: US FDA Classification

Navigating Risk

The U.S. FDA has classified cardiovascular monitoring and diagnostic devices as Class II, owing to their moderate to high associated risk. Class II devices are subject to specific regulations encompassing performance standards, premarket data requirements, postmarket surveillance, and labeling. Notably, labeling should include contraindications, adverse reactions, precautions, warnings, and other instructions before the device is released into the market.

Market Segmentation

The cardiovascular monitoring and diagnostic devices and equipment market are segmented based on three key factors:

- Product Type

- Cardiopulmonary Stress Testing Systems

- ECG Data Management Systems

- ECG Monitoring Equipment

- ECG Stress Testing Systems

- Event Monitoring Systems

- Holter Monitoring Systems

- Type

- Heart Disease

- Coronary Heart Disease

- End-Use

- Hospitals/Physician Clinic (Continuous Glucose Monitors)

- Home/Emergency

- Research and Development (Clinical Trials, Universities, CRO)

Regional Dominance

In 2023, North America emerged as the largest region in the global cardiovascular monitoring and diagnostic devices and equipment market. This highlights the region’s significant contribution to the advancement of cardiovascular health and the adoption of monitoring technologies.

In conclusion, the cardiovascular monitoring and diagnostic devices market are witnessing substantial growth fueled by technological innovations, product launches, and a response to the escalating prevalence of risk factors such as obesity and diabetes. As the industry embraces advancements like AI-enhanced diagnostics and remote monitoring, the trajectory indicates sustained expansion with a focus on improving heart health globally.

Request A Sample Of The Global Cardiovascular Monitoring And Diagnostic Devices And Equipment Market Report 2023:

https://www.thebusinessresearchcompany.com/sample_request?id=2423&type=smp

About Company: TBRC

As a premier market research firm, we specialize in delivering comprehensive insights into customer behavior, market trends, product landscapes, and competitor analysis. Our expertise lies in extracting actionable intelligence through methods such as secondary research, expert interviews, proprietary data, and our extensive in-house knowledge base. With a dedicated team of over 350 experts spanning 28 countries, we curate a repository of 1.5 million datasets across 27 diverse industries, including services, manufacturing, healthcare, financial services, and technology. Our tailored intelligence services empower strategic decision-making, guiding you in market selection, customer targeting, and outmaneuvering competitors.