Clinical Oncology Next Generation Sequencing Market Forecast 2024: Forecast Market Size, Drivers And Key Segments

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2024 and forecasted to 2033

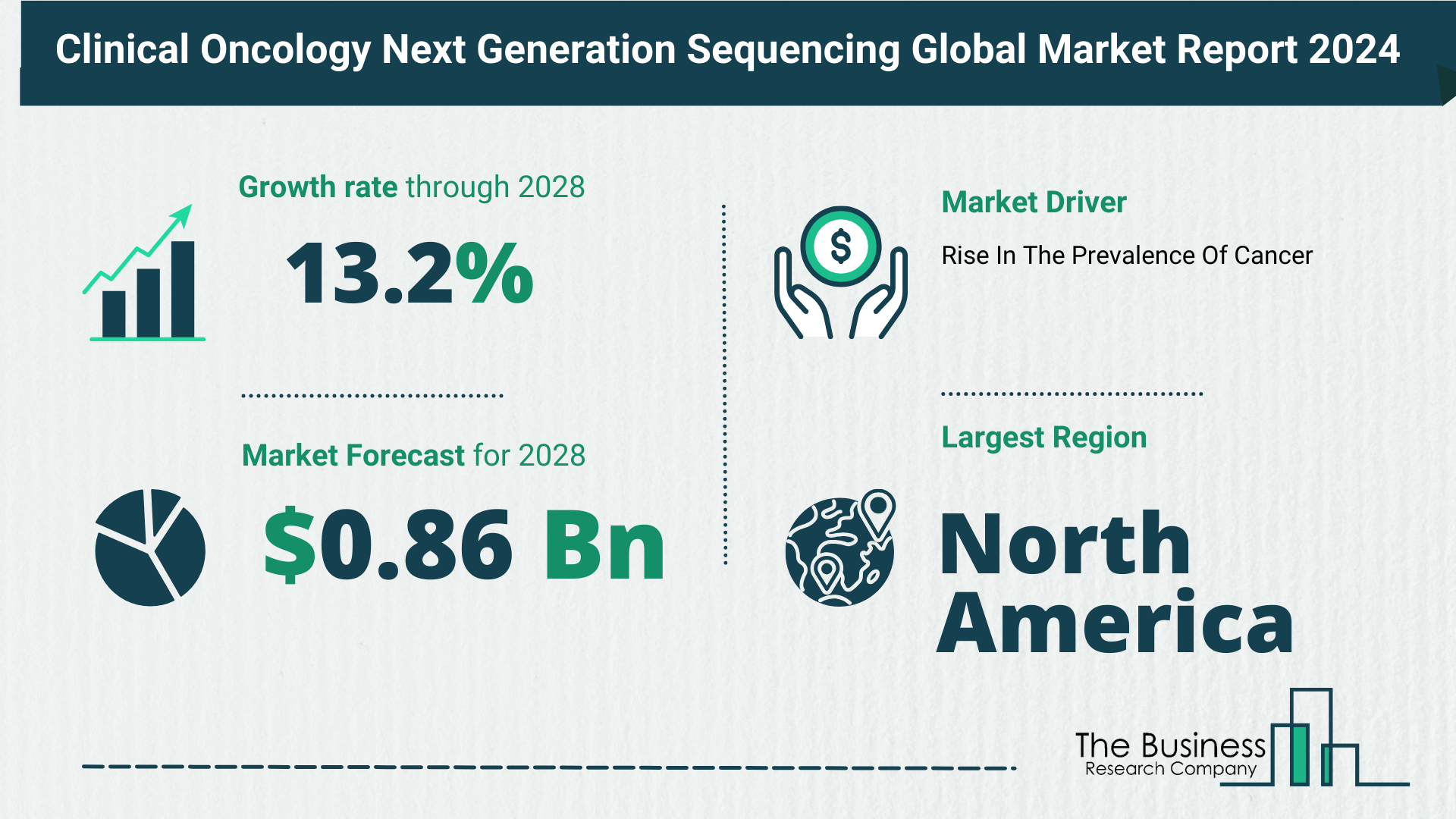

The clinical oncology next-generation sequencing market has experienced rapid expansion in recent years, with a substantial increase from $0.45 billion in 2023 to $0.52 billion in 2024, marking an impressive Compound Annual Growth Rate (CAGR) of 15.5%. This growth in the historic period is attributed to advancements in genomic research, cancer biomarker discovery, technological progress, and regulatory approvals.

Future Projections

Anticipated to sustain its momentum, the market is poised for continued growth. Forecasts indicate an expansion to $0.86 billion in 2028, with a CAGR of 13.2%. The projected surge in the clinical oncology next-generation sequencing market in the forecast period can be linked to factors like the growing incidence of cancer, precision medicine, advancements in immuno-oncology, and the rise of liquid biopsies.

Cancer Prevalence as a Catalyst for Growth

Rising Cancer Cases

The escalating prevalence of cancer emerges as a driving force behind the growth of the clinical oncology next-generation sequencing market. Defined by the uncontrolled growth and spread of abnormal cells, cancer necessitates advanced technologies like Next-Generation Sequencing (NGS) to identify new and rare mutations. In 2021, the American Cancer Society estimated 1.9 million new cancer cases and 608,570 deaths in the United States alone, underscoring the urgency for robust diagnostic tools.

Role of NGS

NGS plays a pivotal role in understanding the molecular underpinnings of individual tumors, enabling a more targeted and personalized approach to cancer treatment. As the prevalence of cancer continues to rise globally, the demand for clinical oncology next-generation sequencing solutions is expected to surge.

View More On The Clinical Oncology Next Generation Sequencing Market Report 2024 – https://www.thebusinessresearchcompany.com/report/clinical-oncology-next-generation-sequencing-global-market-report

Innovative Products Driving Profitability

Strategic Innovations

Major players in the market, including Thermo Fisher Scientific, Illumina, and Roche, are actively innovating to introduce cutting-edge products. For example, Roche’s BenchMark ULTRA PLUS system is a testament to the industry’s commitment to innovation. Launched in June 2022, this system enhances the accuracy and efficiency of diagnostic tests, contributing to improved patient care.

Product Impact on Profitability

Innovative products not only contribute to scientific advancements but also play a significant role in boosting profitability. The BenchMark ULTRA PLUS System, by streamlining diagnostic tests and delivering rapid and accurate results, exemplifies the synergy between technological innovation and market profitability.

Strategic Acquisitions for Market Expansion

Agilent’s Strategic Move

Agilent Technologies, a key player in life sciences technology, made a strategic move in April 2021 by acquiring Resolution Bioscience. This undisclosed acquisition aimed to bolster Agilent’s capabilities in next-generation sequencing for cancer diagnostics. Resolution Bioscience, known for its precision oncology solutions, positions Agilent at the forefront of NGS-based cancer diagnostics.

Market Segmentation and Regional Dominance

Segmentation Overview

The clinical oncology next-generation sequencing market is segmented based on technology, application, and end-user. Key segments include Ion Semiconductor Sequencing, Pyro-Sequencing, Synthesis Sequencing, Real Time Sequencing, Ligation Sequencing, Reversible Dye Termination Sequencing, Nano-Pore Sequencing, with applications spanning Screening, Companion Diagnostics, and Other Diagnostics. End-users range from Hospital Laboratories and Clinical Research Organizations to Diagnostic Laboratories.

Regional Dominance

North America emerged as the largest region in the clinical oncology next-generation sequencing market in 2023. This regional dominance reflects the concentrated efforts and investments in advanced healthcare technologies and research initiatives.

Conclusion

In conclusion, the clinical oncology next-generation sequencing market’s dynamic growth trajectory underscores its pivotal role in advancing cancer diagnostics and treatment. With rising cancer incidence, strategic innovations, and regional dominance in North America, the market is poised for further expansion. As technological breakthroughs continue to shape the landscape, the integration of NGS in precision medicine and immuno-oncology holds the promise of transforming cancer care on a global scale.

Request A Sample Of The Global Clinical Oncology Next Generation Sequencing Market Report 2024:

https://www.thebusinessresearchcompany.com/sample_request?id=3344&type=smp