Top 5 Insights From The Cold Chain Temperature Monitoring Market Report 2024

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2024 and forecasted to 2033

According to The Business Research Company’s Cold Chain Temperature Monitoring Global Market Report 2024, the cold chain temperature monitoring market is expected to show promising growth in the forecast period.

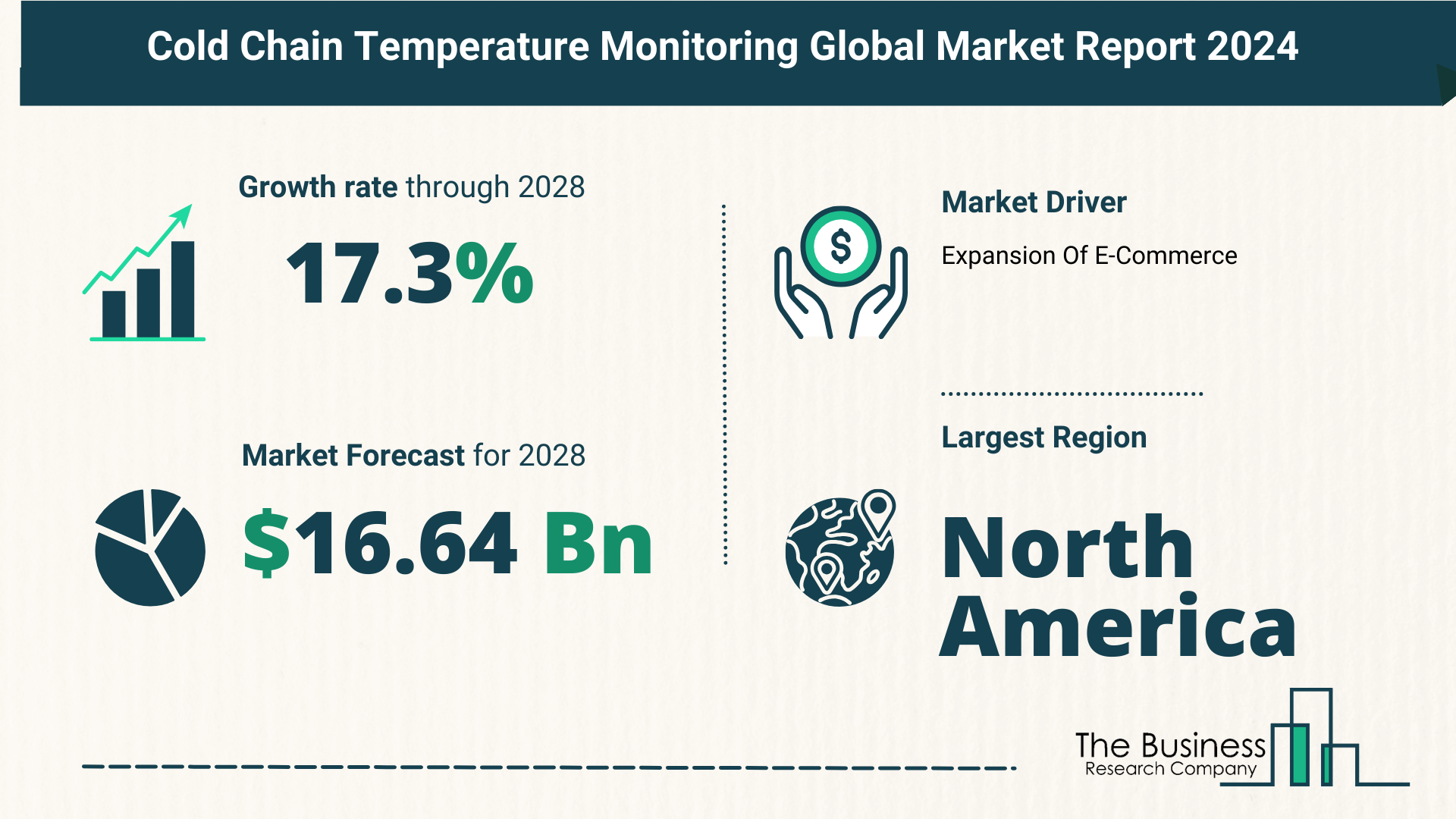

Rapid Expansion Projections

- Market size surge from $7.52 billion in 2023 to $8.79 billion in 2024.

- Compound Annual Growth Rate (CAGR) of 16.9% attributed to various factors:

- Increased global trade.

- Rising demand for pharmaceutical products.

- Importance of maintaining product quality.

- Growing availability of cold chain logistics.

- Focus on predictive maintenance.

- Forecasted growth to $16.64 billion in 2028 with a CAGR of 17.3%.

- Factors driving this growth:

- Integration of emerging technologies.

- Expansion and enhancement of product portfolios.

- Adoption of innovative temperature monitoring solutions.

- Increasing demand in developing countries.

- Focus on automation and cold storage technologies.

E-Commerce Expansion Fuels Demand For Cold Chain Temperature Monitoring Solutions

- E-commerce expansion acts as a catalyst for market growth.

- Cold chain systems crucial for maintaining product quality in e-commerce.

- Real-time visibility and control crucial for compliance and customer satisfaction.

- Example: US e-commerce sales in 2023 reached $1,118.7 billion, up 7.6% from 2022.

View More On The Cold Chain Temperature Monitoring Market Report 2024 – https://www.thebusinessresearchcompany.com/report/cold-chain-temperature-monitoring-global-market-report

Key Players in the Market

- Zebra Technologies Corporation

- Cryoport Inc.

- Cold Chain Technologies

- Controlant

- Sensitech Inc.

- OMEGA Engineering inc.

- Luna

- Elitech

- MOBIQU

- Thermo Electric Company Inc.

- DeltaTrak Inc.

- Berlinger & Co. AG

- Insignia Technologies

- AeroSafe Global

Technology Solutions Driving Efficiency In Cold Chain Temperature Monitoring

- Development of innovative trackers like CubiSens XT1.

- CubiSens XT1 integrates various sensors for comprehensive monitoring.

- Aimed at optimizing agricultural processes and increasing efficiency.

- Example: CubeWorks launched CubiSens XT1 in September 2022.

Azenta Enhances Cold Chain Capabilities With Acquisition Of B Medical Systems SA

- Acquisition strengthens cold chain capabilities of Azenta Inc.

- Acquisition of B Medical Systems SA brings enhanced solutions for temperature-sensitive specimens transport.

- B Medical Systems SA is a Luxembourg-based medical refrigeration manufacturer.

Market Segmentation

- Segmented by Hardware:

- Conventional Temperature Loggers.

- Real-Time Monitoring Devices.

- Resistance Temperature Detectors.

- Temperature Indicators.

- Other Hardware.

- Segmented by Software:

- On Premise.

- Cloud Based.

- Segmented by End User:

- Fish, Meat And Seafood.

- Processed Food.

- Bakery And Confectionaries.

- Fruits And Vegetables.

- Dairy Products.

- Other End Users.

Regional Insights

- North America led the market in 2023.

- Asia-Pacific expected to be the fastest-growing region in the forecast period.

In conclusion, the cold chain temperature monitoring market is poised for substantial growth driven by various factors such as e-commerce expansion, technological advancements, and strategic acquisitions. Key players are innovating with new solutions to meet the evolving demands of diverse industries, promising a future of enhanced efficiency, compliance, and product quality assurance across the supply chain.

Request A Sample Of The Global Cold Chain Temperature Monitoring Market Report 2024:

https://www.thebusinessresearchcompany.com/sample_request?id=14676&type=smp