How is the Diabetes Care Devices Market Poised for Growth: Trends and Opportunities Through 2034

Updated 2025 Market Reports Released: Trends, Forecasts to 2034 – Early Purchase Your Competitive Edge Today!

How has the diabetes care devices market size evolved in recent years?

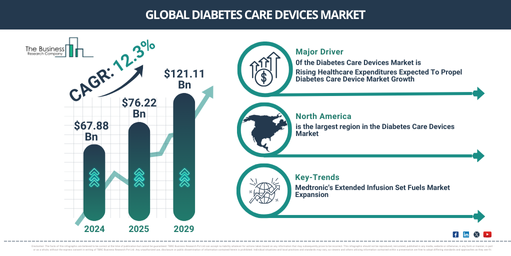

The market size for diabetes care devices has experienced a swift expansion in the past few years. It is projected to escalate from $67.88 billion in 2024 to $76.22 billion in 2025, with a compound annual growth rate (CAGR) of 12.3%. The rise in this historical phase is due to factors such as the growing prevalence of diabetes, economic development, reforms in public health insurance, a surge in the elderly population, and an increase in healthcare spending.

What are the predictions for the diabetes care devices market size in the coming years?

The equine healthcare market is predicted to witness significant expansion in the forthcoming years, anticipated to rise to a value of $1.91 billion by 2029, with a compound annual growth rate (CAGR) of 6.4%. This predicted growth during the forecasting period can be associated with factors such as genetic testing and personalized medicine, equine wellness initiatives, the global proliferation of equine events, readiness for zoonotic diseases, and adherence to anti-doping rules. Key trends set to shape this period will be the adoption of telemedicine and remote monitoring solutions, horse wearable technologies, therapies related to equine rehabilitation and physical therapy, equine oral health and dental services, as well as herbal and alternative treatment methods.

Get your diabetes care devices market report here!

https://www.thebusinessresearchcompany.com/report/diabetes-care-devices-global-market-report

What key factors are fueling the growth of the diabetes care devices market?

The diabetes care device market is predicted to expand due to escalating healthcare costs. These expenditures symbolize the aggregate sum invested on medical services, goods, and activities over a given timeframe, usually at an individual, community, national, or international scale. The rise in healthcare expenditures, together with increased access to healthcare services and a surge in diabetes diagnoses, stimulate an upsurge in research and development investment. This leads to the evolution of diabetes care appliances including enhanced glucose monitoring systems, insulin delivery gadgets, and digital health solutions. For instance, Eurostat, a European governmental agency, reported in November 2023 that social protection expenditure on illness and healthcare in the EU in 2022 peaked at 8.1% of GDP. Out of the 24 EU nations with available data, expenditure was highest in France at 10.0%, followed by Germany at 9.7%, while it was lowest in Bulgaria at 4.2%. Other countries with relatively low spending constitute Ireland with 4.6%, Hungary and Lithuania with 4.7%, and Estonia with 4.8%. Hence, the rising healthcare expenditure is projected to fuel the expansion of the diabetes care device market in the future.

How is the global diabetes care devices market divided into key segments?

The diabetes care devices market covered in this report is segmented –

1) By Type: Blood Glucose Test Strips, Insulin Pens, Syringes, Pumps And Injectors, Lancing Devices And Equipment, Continuous Glucose Monitoring Devices And Equipment, Blood Glucose Meters

2) By Type of Expenditure: Public, Private

3) By Product: Instruments Or Equipment, Disposables

4) By Type Of Testing: Point Of Care (POC) Testing, Non-Point Of Care (POC) Testing

5) By End User: Hospitals And Clinics, Diagnostic Laboratories, Other End Users

Subsegments:

1) By Blood Glucose Test Strips: Standard Blood Glucose Test Strips, Test Strips for Continuous Glucose Monitors

2) By Insulin Pens: Pre-filled Insulin Pens, Reusable Insulin Pens, Smart Insulin Pens

3) By Syringes: Insulin Syringes (various capacities), Disposable Syringes, Safety Syringes

4) By Pumps and Injectors: Insulin Pumps, Insulin Jet Injectors, Patch Pumps

5) By Lancing Devices and Equipment: Manual Lancing Devices, Automatic Lancing Devices, Lancets (various gauges)

6) By Continuous Glucose Monitoring Devices and Equipment: Real-Time CGM Systems, Flash Glucose Monitoring Systems, CGM Sensors and Transmitters

7) By Blood Glucose Meters: Standard Blood Glucose Meters, Smart Blood Glucose Meters, Meters with Integrated Data Management

Get your free sample now – explore exclusive market insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=3609&type=smp

Who are the key firms paving the way for growth in the diabetes care devices market?

Major companies operating in the diabetes care devices market include Becton Dickinson and Company, Roche Holding AG, Nipro Corporation, HTL-STREFA Inc., ARKRAY, Terumo Corporation, Owen Mumford, Ypsomed AG, Vogt Medical, Sanofi India, Biocon Ltd, Mehar healthcare, Johnson & Johnson, Shandong WeiGao Group Medical Polymer Company Limited, Yuwell medical equipment & supply Co, Medtronic, Emperra GmbH E-Health, Novo Nordisk A/S, Insujet, Eli Lilly, Fresenius Medical Care, Siemens, Stryker, Teleflex Medical, LifeScan, Ascensia Diabetes Care, Tandem Diabetes Care, Dexcom Inc., SocialDiabetes, Dottli, Themis Bioscience, Ok biotech, Acon Laboratories, Bayer AG, AgaMatrix.

Which trends are expected to transform the diabetes care devices market?

Leading companies in the diabetes care devices market, such as Medtronic, are focusing on launching innovative products like the Medtronic Extended Infusion set to boost their market profits. This infusion set, which is a tube that channels insulin from the pump to the patient’s body, is engineered to last up to a week. In November 2022, for example, Medtronic, an American medical device firm, introduced their Extended Infusion set. This set leverages advanced materials to reduce insulin preservative loss and enhance flow, effectively extending the wear time of the set by double. The innovative features of this set include a new tubing connector and a robust adhesive patch, which ensure insulin stability and user comfort for up to seven days.

Unlock exclusive market insights – purchase your research report now for a swift delivery!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=3609

What regions are contributing significantly to the growth of the diabetes care devices market?

North America was the largest region in the global diabetes care devices market in 2024. Western Europe was the second largest region in the global diabetes care devices market. The regions covered in the diabetes care devices market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Browse Through More Similar Reports By The Business Research Company:

Veterinary Antibiotics Global Market Report 2024

https://www.thebusinessresearchcompany.com/report/veterinary-antibiotics-global-market-report

Veterinary Pain Management Global Market Report 2024

https://www.thebusinessresearchcompany.com/report/veterinary-pain-management-global-market-report

Veterinary Vaccines Global Market Report 2024

https://www.thebusinessresearchcompany.com/report/veterinary-vaccines-global-market-report

About The Business Research Company:

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead in the game.

Contact us at:

The Business Research Company: https://www.thebusinessresearchcompany.com/

Americas +1 3156230293

Asia +44 2071930708

Europe +44 2071930708

Email us at [email protected]

Follow us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

Found this article helpful? Share it on: