Comprehensive Analysis On Size, Share, And Drivers Of The Endocrine Testing Market

The Business Research Company’s global market reports provide comprehensive analysis on the various markets in 27 industries across 60 geographies.

Market Overview

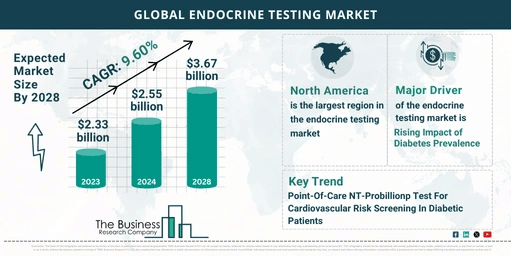

- 2023 Market Size: $2.33 billion

- 2024 Projected Market Size: $2.55 billion

- CAGR (2023-2024): 9.4%

The endocrine testing market has shown robust growth, driven by advances in hormone research, diagnostic standardization, public health initiatives, and patient empowerment. The rising prevalence of endocrine disorders and advancements in testing technologies are key factors contributing to this growth.

Future Market Growth

- 2028 Projected Market Size: $3.67 billion

- CAGR (2024-2028): 9.6%

The market is expected to continue expanding, supported by increasing awareness and early diagnosis, an aging population, and technological advancements in biomarker detection and testing methods. Key trends include the integration of omics technologies and artificial intelligence.

View More On The Endocrine Testing Market Report 2024 –

https://www.thebusinessresearchcompany.com/report/endocrine-testing-global-market-report

Key Trends and Drivers

- Impact of Diabetes Prevalence: The rising incidence of diabetes is a significant driver for the endocrine testing market. Diabetes is linked to various endocrine dysfunctions, making effective testing crucial for diagnosis and management. According to the International Diabetes Federation, approximately 537 million adults were living with diabetes in 2021, with numbers projected to rise to 643 million by 2030 and 783 million by 2045. Endocrine tests like hemoglobin A1c, fasting plasma glucose, and C-peptide are vital for monitoring diabetes.

- Advancements in Biomarker Detection: Innovations in biomarker detection are enhancing the accuracy and efficiency of endocrine testing. Technologies such as tandem mass spectrometry and advanced immunoassays are leading the way.

- Point-of-Care Testing Solutions: The development of point-of-care testing solutions is improving accessibility and efficiency in diagnosing endocrine disorders. For instance, Roche Holding AG’s launch of a point-of-care NT-proBNP test in April 2024 helps in screening diabetes patients at risk of cardiovascular diseases, facilitating early detection and intervention.

- Integration of Omics Technologies: The integration of omics technologies, including genomics and proteomics, is enabling more comprehensive and personalized approaches to endocrine testing.

- Artificial Intelligence and Machine Learning: AI and machine learning are being increasingly used to enhance diagnostic accuracy and streamline testing processes.

Major Companies and Innovations

- Key Players: Thermo Fisher Scientific Inc., Abbott Laboratories, Roche Holding, Siemens Healthineers, Quest Diagnostics, Agilent Technologies Inc., PerkinElmer Inc., BioMérieux SA, Beckman Coulter Inc., and others.

- Product Innovations: Companies are focusing on developing advanced testing solutions, including novel biomarker detection technologies and point-of-care tests. For example, Roche’s NT-proBNP test for cardiovascular risk screening in diabetic patients is an innovative product enhancing early detection and patient management.

Strategic Acquisitions

- Tolmar Pharmaceuticals and Jatenzo: In October 2022, Tolmar Pharmaceuticals acquired Jatenzo from Clarus Therapeutics. This acquisition enhances Tolmar’s portfolio in specialty pharmaceuticals, particularly in testosterone replacement therapy, complementing their focus on pediatric endocrinology and men’s health.

Market Segmentation

- By Test Type: Estradiol (E2), Follicle Stimulating Hormone (FSH), Human Chorionic Gonadotropin (hCG), Luteinizing Hormone (LH), Dehydroepiandrosterone Sulfate (DHEAS), Progesterone, Testosterone, Thyroid Stimulating Hormone (TSH), Prolactin, Other Types

- By Technology: Tandem Mass Spectrometry, Immunoassay, Monoclonal & Polyclonal Antibody Technologies, Sensor Technology, Clinical Chemistry, Other Technologies

- By End-User: Hospitals, Clinical Laboratories, Diagnostic Centers, Other End-Users

Regional Insights

- North America:The largest region in the endocrine testing market in 2023, driven by high healthcare standards, advanced diagnostic infrastructure, and significant investments in research and development.

- Asia-Pacific:Expected to be the fastest-growing region during the forecast period, due to increasing healthcare spending, rising prevalence of endocrine disorders, and growing awareness in emerging markets.

Conclusion

The endocrine testing market is poised for continued strong growth, driven by advancements in technology, increasing prevalence of endocrine disorders, and the rising demand for early and accurate diagnosis. Innovations in testing methods and strategic acquisitions are shaping the future of the market.

Request A Sample Of The Global Endocrine Testing Market Report 2024:

https://www.thebusinessresearchcompany.com/sample_request?id=15562&type=smp