Feed And Animal Nutrition Market Report 2024: Market Size, Drivers, And Trends

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2024 and forecasted to 2033

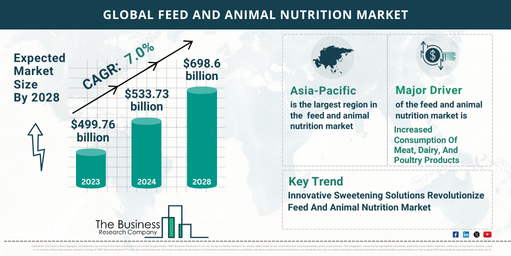

- Impressive Market Expansion: The feed and animal nutrition market has experienced robust growth, expanding from $499.76 billion in 2023 to an anticipated $533.73 billion in 2024, reflecting a compound annual growth rate (CAGR) of 6.8%. This growth has been driven by various factors including the rise in livestock farming, increased meat and dairy consumption, and growing incomes in developing countries.

- Future Growth Projections: The market is expected to continue its upward trajectory, reaching $698.61 billion by 2028 with a CAGR of 7%. Key drivers for this future growth include heightened consumer awareness of animal health, the shift toward sustainable farming practices, and the booming aquaculture industry.

Key Trends Shaping the Market

- Advanced Data Analytics and AI: The integration of advanced data analytics and AI is revolutionizing feed formulation, allowing for more tailored and efficient nutritional solutions.

- Sustainable Feed Ingredients: The industry is increasingly focusing on alternative and sustainable feed ingredients, reflecting a broader move toward eco-friendly farming practices.

- Health-Boosting Additives: There is a growing trend toward the development of feeds enriched with health benefits, such as probiotics, prebiotics, and immune-boosting ingredients.

- Automation and IoT: The incorporation of automation and Internet of Things (IoT) technologies in feed production and distribution is enhancing efficiency and traceability.

- Genetic Research: Genetic research is being applied to improve feed conversion ratios, contributing to more sustainable and productive farming practices.

View More On The Feed And Animal Nutrition Market Report 2024 – https://www.thebusinessresearchcompany.com/report/feed-and-animal-nutrition-global-market-report

Rising Global Consumption of Meat, Dairy, and Poultry

- Driving Market Demand: The increased global consumption of meat, dairy, and poultry products is a significant driver of the feed and animal nutrition market. This trend is fueled by a rising global population, changing dietary habits, and a growing demand for protein-rich foods.

- Sustainable Farming: The development of feed and animal nutrition solutions plays a crucial role in enhancing the quality and productivity of meat, dairy, and poultry products, contributing to sustainable farming practices and improved food safety standards.

Major Players in the Market

- Key Companies: Major companies in the market include Cargill Incorporated, Archer Daniels Midland Company, BASF SE, and Tyson Foods Inc., among others. These companies are leading the way in developing innovative products and expanding their global footprint.

Innovation in Sweetening Solutions

- Enhancing Feed Palatability: Leading companies are focusing on innovative in-feed sweetening solutions to improve the palatability of animal feed, particularly during critical growth stages. For example, Archer-Daniels-Midland Company (ADM) launched the SUCRAM range in November 2022, designed to encourage feed intake in weanling pigs.

- Product Benefits: These sweetening solutions are aimed at optimizing nutrient absorption, supporting gut health, and promoting growth and performance in young animals during the transition from liquid to solid feed.

Strategic Acquisitions Strengthen Market Position

- ADM’s Acquisition: In December 2023, ADM acquired PT Trouw Nutrition Indonesia, enhancing its capabilities in the animal nutrition industry, particularly in the Asia-Pacific region. This acquisition underscores the importance of strategic partnerships in maintaining a competitive edge in the market.

Market Segmentation and Regional Insights

- Product Segmentation: The market is segmented by product type into amino acids, vitamins, minerals, enzymes, fish oils, and more. Additionally, segmentation by species includes poultry, swine, ruminants, and pets, while administrative methods include oral, topical, and injection.

- Regional Dominance: Asia-Pacific was the largest region in the feed and animal nutrition market in 2023, driven by the region’s large population, growing income levels, and rising demand for animal-based products.

This comprehensive overview of the feed and animal nutrition market highlights the key trends, growth drivers, and major players shaping the industry’s future. As consumer demand for high-quality animal products continues to rise, the market is set to expand further, driven by innovation, strategic acquisitions, and sustainable practices.

Request A Sample Of The Global Feed And Animal Nutrition Market Report 2024:

https://www.thebusinessresearchcompany.com/sample_request?id=15810&type=smp