Understand How The Gastrointestinal Pathogen Testing Market Is Poised To Grow Through 2024-2033

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2024 and forecasted to 2033

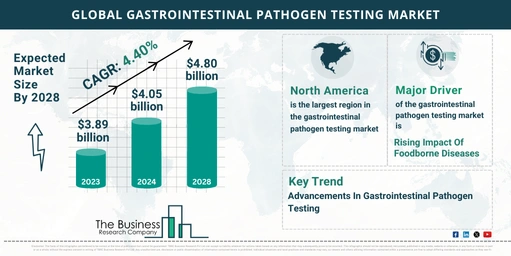

As per The Business Research Company’s Gastrointestinal Pathogen Testing Global Market Report 2023, the gastrointestinal pathogen testing market is expected to show significant growth in the forecast period.

Market Overview

- 2023 Market Size: $3.89 billion

- 2024 Projected Market Size: $4.05 billion

- CAGR (2023-2024): 4.2%

The gastrointestinal pathogen testing market has grown steadily, driven by the increased prevalence of gastrointestinal infections, heightened awareness of foodborne illnesses, globalization leading to travel-related infections, regulatory initiatives for food safety, and a rise in healthcare expenditure. The demand for rapid and accurate diagnostic solutions has further bolstered market growth.

Future Market Growth

- 2028 Projected Market Size: $4.80 billion

- CAGR (2024-2028): 4.4%

The market is expected to maintain steady growth in the coming years. Factors such as the global increase in gastrointestinal infections, the importance of early detection and treatment, expanding healthcare infrastructure, and the rising demand for point-of-care testing solutions will drive growth. Additionally, stricter food safety regulations and continuous R&D efforts will play crucial roles.

View More On The Gastrointestinal Pathogen Testing Market Report 2024 –

https://www.thebusinessresearchcompany.com/report/gastrointestinal-pathogen-testing-global-market-report

Key Trends and Drivers

- Impact of Foodborne Diseases: The rising incidence of foodborne diseases is a significant driver for the gastrointestinal pathogen testing market. These diseases, caused by consuming contaminated food or beverages, have increased due to changes in food production, distribution, and inadequate safety measures. Gastrointestinal pathogen testing is essential in identifying specific pathogens, guiding treatment, tracking outbreaks, and preventing the spread of these diseases. For example, England and Wales reported 167 cases of listeriosis in 2022, up from 160 cases in 2021, highlighting the ongoing need for effective testing solutions.

- Rapid Testing Methods: The market is witnessing a shift towards rapid testing methods that offer quicker diagnosis, aiding in timely treatment and outbreak control. These advancements are crucial in managing the spread of gastrointestinal infections.

- Molecular Diagnostics: The adoption of molecular diagnostic techniques is increasing due to their accuracy and speed. These methods are becoming more common in both traditional and non-traditional healthcare settings, providing more accessible and efficient testing solutions.

- Automation and Robotics: Advancements in automation and robotics are streamlining testing processes, reducing human error, and increasing throughput, which is particularly important in high-demand scenarios like foodborne illness outbreaks.

- Novel Biomarkers: The emergence of novel biomarkers for pathogen detection is enhancing the accuracy and comprehensiveness of gastrointestinal testing, allowing for better disease management and prevention strategies.

- AI and Machine Learning: The integration of AI and machine learning algorithms is revolutionizing pathogen detection, enabling faster and more precise identification of infections, which can lead to improved patient outcomes.

Leading Companies and Innovations

- Major Players: Thermo Fisher Scientific Inc., Abbott Laboratories, F. Hoffmann-La Roche Ltd., Becton Dickinson and Company, Hologic Inc., bioMérieux S.A., Bio-Rad Laboratories Inc., QIAGEN N.V., and others dominate the market, offering a wide range of diagnostic solutions.

- Metagenomic Diagnostic Tests: Companies are focusing on developing advanced diagnostic solutions like metagenomic diagnostic tests. For example, in April 2024, Microba Life Sciences launched MetaPanel, a test designed to identify a wide range of gastrointestinal pathogens with high accuracy. This test covers 175 pathogen targets and uses next-generation sequencing (NGS) technology, offering comprehensive diagnostic capabilities.

Strategic Acquisitions

- SSID and TechLab Acquisition: In August 2022, SSI Diagnostica Group acquired TechLab, a move aimed at expanding SSID’s infectious disease product portfolio and accelerating growth in the US market. This acquisition strengthens SSID’s commercial and manufacturing capabilities, particularly in the crucial US market.

Market Segmentation

- By Pathogen Type: Bacteria, Viruses, Parasites

- By Test Type: Molecular Tests, Culture, Biochemical Tests, Other Test Types

- By Panel Type: Syndromic Full Multiplex Panels, Other Panel Types

- By End-User: Hospitals, Diagnostic Laboratories, Point-Of-Care, Other End Users

Regional Insights

- North America: The largest region in the gastrointestinal pathogen testing market in 2023, driven by strong healthcare infrastructure and significant investment in diagnostic technologies.

- Asia-Pacific: Expected to be the fastest-growing region during the forecast period, propelled by expanding healthcare infrastructure, rising awareness of food safety, and increasing prevalence of gastrointestinal infections.

Conclusion

The gastrointestinal pathogen testing market is set to grow steadily, driven by the increasing incidence of gastrointestinal infections and foodborne diseases, along with advancements in testing technologies. The ongoing development of rapid and accurate diagnostic solutions, combined with strategic industry acquisitions, will further enhance market growth.

Request A Sample Of The Global Gastrointestinal Pathogen Testing Market Report 2024:

https://www.thebusinessresearchcompany.com/sample_request?id=15571&type=smp