How Is The Implantable Biomaterials Market Expected To Grow Through 2024-2033

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2024 and forecasted to 2033

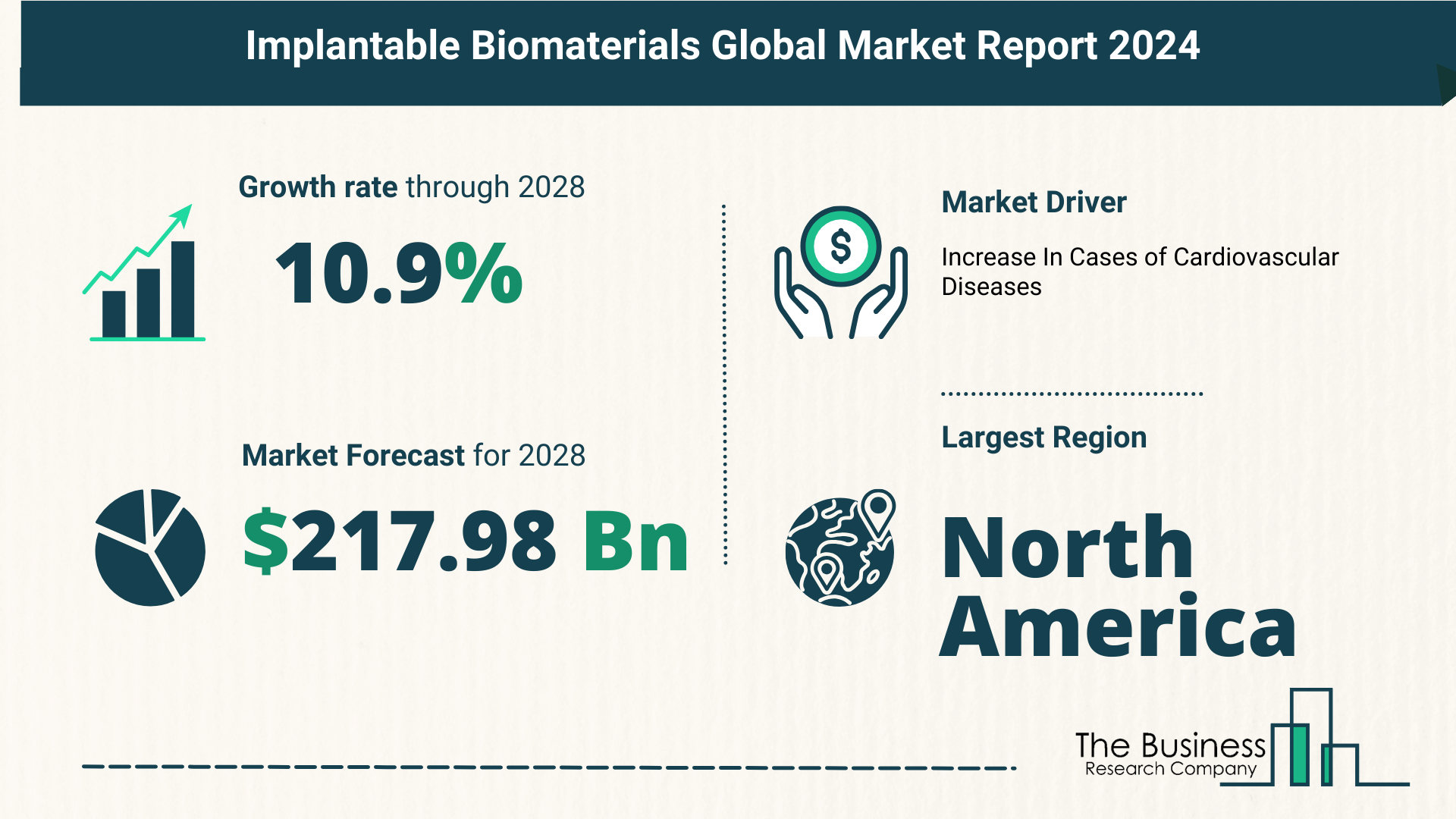

According to The Business Research Company’s Implantable Biomaterials Global Market Report 2024, the implantable biomaterials market is expected to show promising growth in the forecast period.

The implantable biomaterials market size has grown rapidly in recent years, reaching $127.97 billion in 2023 and expected to grow to $144.1 billion in 2024. The compound annual growth rate (CAGR) stands at an impressive 12.6%.

- Factors Contributing to Growth

- Clinical success and patient outcomes

- Progress in tissue engineering

- Advancements in surface modification techniques

- Regulatory milestones

- Introduction of biodegradable materials

Projected Growth and Key Trends

Expectations for the market indicate further expansion, with a forecasted size of $217.98 billion in 2028, boasting a CAGR of 10.9%. Notable trends shaping this growth include the emergence of bioactive and bioresorbable materials, smart biomaterials, and hybrid composites.

- Forecasted Trends

- Drug-eluting implants

- Advancements in biocompatibility

- Emphasis on 3D printing and customization

- Focus on regenerative medicine

- Integration of nanotechnology

View More On The Implantable Biomaterials Market Report 2024 – https://www.thebusinessresearchcompany.com/report/implantable-biomaterials-global-market-report

Cardiovascular Diseases Fueling Demand

The surge in cardiovascular disease cases is a significant driver of the implantable biomaterials market. These conditions necessitate innovative biomaterials for treatment and management, amplifying demand for such materials.

- Impact of Cardiovascular Diseases

- Increased demand for implantable biomaterials

- Role of biomaterials in repairing damaged cardiovascular tissues

- Statistical insights into cardiovascular disease prevalence

Innovation Revolutionizing the Market

Major players are channeling efforts into developing cutting-edge technologies and products for orthopedic surgical applications, leveraging biomaterial technology to enhance patient outcomes.

- Example of Innovative Technology

- Introduction of CITREGEN by Acuitive Technologies Inc.

- Unique properties and applications of CITREGEN in orthopedic surgeries

Integer Holdings Corp. Expands Portfolio

Integer Holdings Corporation’s acquisition of Connemara Biomedical Holdings Teoranta underscores the growing importance of biomaterial technology in medical device companies’ strategies.

- Acquisition Impact

- Strengthening of Integer Holdings Corp.’s biomaterial technology portfolio

- Expansion of market reach and growth opportunities

Market Segmentation

The implantable biomaterials market is segmented based on material, application, and end-user, providing a comprehensive view of its diverse landscape.

- Segmentation Overview

- By Material: Metallic, Ceramic, Polymers, Natural

- By Application: Dental, Cardiovascular, Ophthalmology, Orthopedic, Others

- By End-user: Hospitals, Ambulatory Surgical Centers, Specialty Clinics

Regional Dominance of North America

In 2023, North America emerged as the largest region in the implantable biomaterials market, showcasing the region’s pivotal role in driving market growth.

As the demand for implantable biomaterials continues to soar, fueled by technological advancements and the increasing prevalence of chronic diseases, the market’s trajectory remains poised for significant expansion. With innovation at its core and a focus on addressing critical medical needs, the future of implantable biomaterials presents promising opportunities for both companies and patients alike.

Request A Sample Of The Global Implantable Biomaterials Market Report 2024:

https://www.thebusinessresearchcompany.com/sample_request?id=3274&type=smp