Future Growth Forecast For The Infectious Disease Diagnostics Testing Global Market 2024-2033

The Business Research Company’s global market reports provide comprehensive analysis on the various markets in 27 industries across 60 geographies.

The infectious disease diagnostics testing market has experienced significant growth in recent years and is projected to continue this trend in the coming years. This blog explores the key factors driving this market, the emerging trends, and the future outlook.

Current Market Growth and Drivers

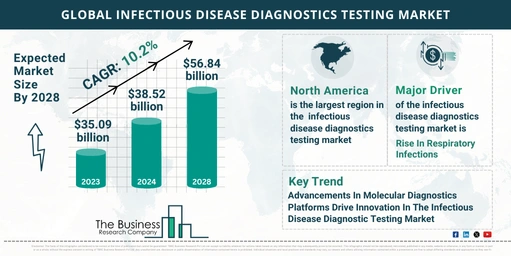

- Market Size and Growth: The infectious disease diagnostics testing market grew from $35.09 billion in 2023 to $38.52 billion in 2024, at a compound annual growth rate (CAGR) of 9.8%.

- Key Drivers: Growth in the historic period is primarily due to:

- Rising disease outbreaks like SARS, Ebola, and Zika.

- Increased awareness among healthcare professionals and the general public about early detection and prevention.

- Government-funded programs for disease surveillance, control, and prevention.

- Increased global travel and trade, facilitating the spread of infectious diseases.

- Higher healthcare spending, especially in emerging economies.

Future Market Outlook and Growth Factors

- Projected Growth: The market is expected to grow to $58.84 billion by 2028, with a CAGR of 10.2%.

- Factors Contributing to Future Growth:

- Emergence of novel pathogens, including new strains of influenza and COVID-19.

- Shift towards personalized medicine and targeted therapies.

- Increasing demand for rapid and on-site testing solutions.

- Emphasis on epidemiological surveillance and early detection systems.

- Enhanced research and development activities focusing on novel diagnostic technologies and biomarkers.

View More On The Infectious Disease Diagnostics Testing Market Report 2024 – https://www.thebusinessresearchcompany.com/report/infectious-disease-diagnostics-testing-global-market-report

Emerging Trends in Infectious Disease Diagnostics

- Miniaturization and Portability: Diagnostic devices are becoming smaller and more portable, allowing for easier on-site testing.

- Multiplex Assays: Adoption of assays capable of detecting multiple pathogens simultaneously is growing.

- Integration of Digital Health Solutions: The use of mobile apps and telemedicine platforms for diagnostics is increasing.

- Next-Generation Sequencing (NGS): This technology is being adopted for more precise diagnostics.

- Advancements in Biosensor Technologies: New biosensor technologies are enabling rapid and sensitive detection of infectious agents.

- Artificial Intelligence (AI) Integration: AI and machine learning algorithms are being incorporated into diagnostic platforms to enhance accuracy and efficiency.

Impact of Rising Respiratory Infections

- Increasing Cases: The rise in respiratory infections is a significant driver of the diagnostic testing market. These infections, which affect the respiratory system, are increasing due to factors like viral and bacterial transmission, poor hygiene practices, crowded living conditions, and seasonal weather changes.

- Importance of Diagnostics: Infectious disease diagnostic testing is crucial for accurately diagnosing and treating respiratory infections. For example, in Canada, hospitalizations for acute upper respiratory infections increased by 32% from 2022 to 2023, highlighting the need for effective diagnostics.

Key Players in the Market

- Major companies in the market include:

- F. Hoffmann-La Roche Ltd.

- Thermo Fisher Scientific Inc.

- Abbott Laboratories

- Danaher Corporation

- Siemens Healthineers AG

- Hologic Inc.

- PerkinElmer Inc.

- Seegene Inc.

- Ortho Clinical Diagnostics Inc.

- OraSure Technologies Inc.

- Meridian Bioscience Inc.

- Inovio Pharmaceuticals Inc.

Advancements in Molecular Diagnostics Platforms

- Technological Innovations: Companies are focusing on developing advanced molecular diagnostics platforms to strengthen their market position. These platforms detect and analyze nucleic acids from biological samples, providing precise diagnostic results.

- Example of Innovation: Becton Dickinson and Company launched the BD COR System, a fully automated, high-throughput molecular diagnostics platform, in May 2022. It processes up to 1,700 specimens and delivers results within 24 hours, streamlining laboratory workflows.

Strategic Acquisitions to Strengthen Market Presence

- Notable Acquisition: SSI Diagnostica Group acquired TechLab Inc. in August 2022 to enhance its infectious disease diagnostics capabilities. This acquisition aligns with SSI’s broader objectives of expanding its portfolio, advancing technology, and increasing market share.

Market Segmentation and Regional Insights

- Market Segmentation:

- By Type: Molecular Diagnostic Test, Point Of Care Tests (POCT) Infectious Disease Diagnostics Test.

- By Application: Respiratory, Human Immunodeficiency Virus (HIV), Healthcare-Associated Infections (HAIs), Sexual Health, Tropical Diseases, Liver.

- By End-User: Diagnostic Laboratories, Hospitals and Clinics, Academic Research Institutes, Other End-Users.

- Regional Insights: North America was the largest region in the infectious disease diagnostics testing market in 2023. Asia-Pacific is expected to be the fastest-growing region during the forecast period.

The infectious disease diagnostics testing market is poised for significant growth, driven by rising disease outbreaks, technological advancements, and strategic acquisitions. As the demand for rapid, accurate diagnostics continues to grow, companies in this market are well-positioned to capitalize on these opportunities.

Request A Sample Of The Global Infectious Disease Diagnostics Testing Market Report 2024:

https://www.thebusinessresearchcompany.com/sample_request?id=15831&type=smp