What’s The Growth Forecast For Interventional Cardiology Devices And Equipment Market Through 2024-2033?

The Business Research Company’s global market reports provide comprehensive analysis on the various markets in 27 industries across 60 geographies.

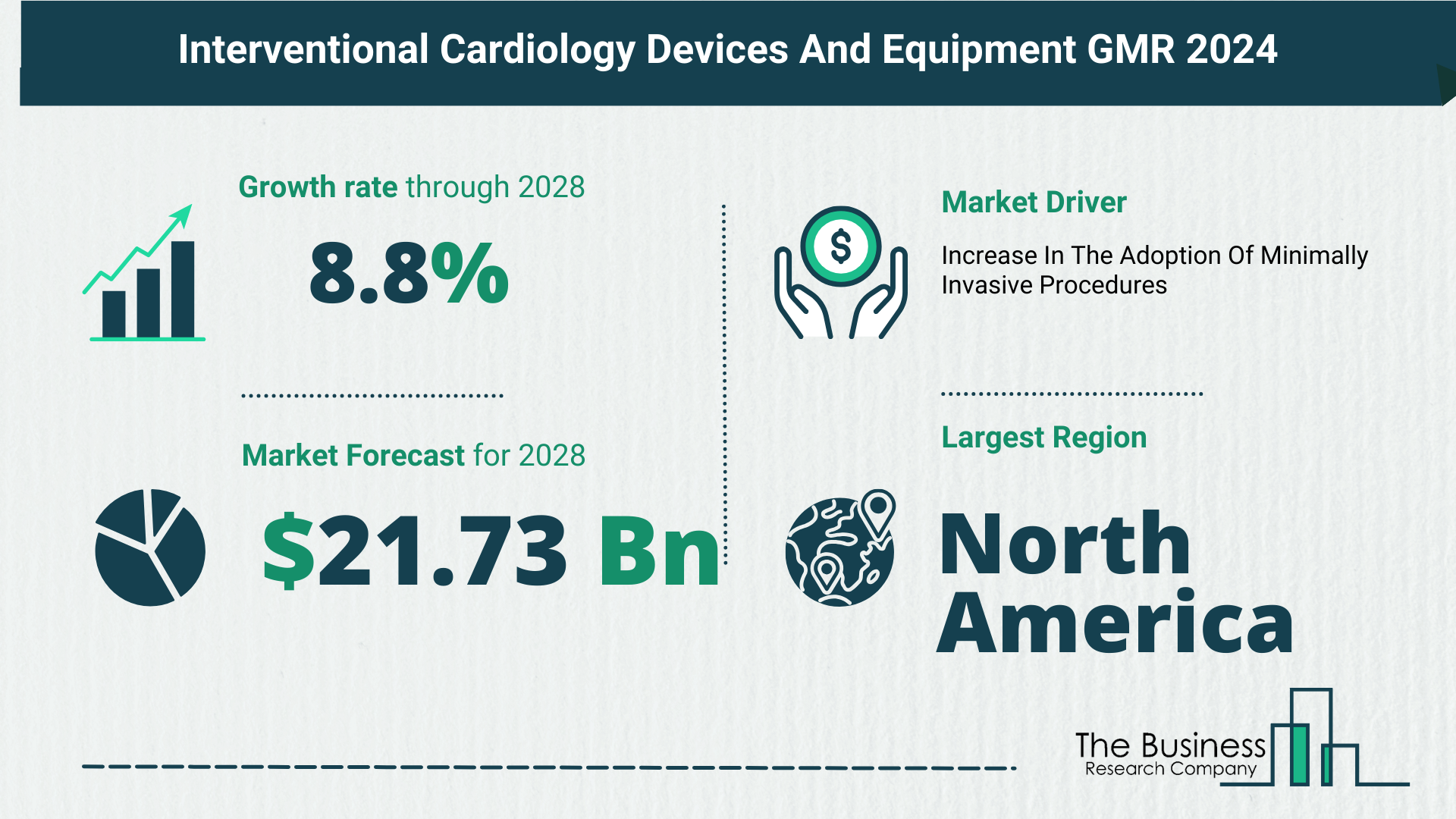

The interventional cardiology devices and equipment market have witnessed robust growth in recent years, reaching $14.1 billion in 2023 and expected to surge to $15.48 billion in 2024 at a remarkable compound annual growth rate (CAGR) of 9.8%. This expansion is attributed to various factors such as the prevalence of cardiovascular diseases, an aging population, increased patient demand for minimally invasive procedures, and advancements in clinical guidelines and research.

Projected Growth and Key Drivers

In the forecast period, the market is poised for further expansion, projected to reach $21.73 billion in 2028 at a CAGR of 8.8%. This anticipated growth is fueled by factors like the advent of personalized medicine, integration of telehealth, global access to healthcare, and the emergence of robot-assisted interventions. Notable trends in this period include the integration of advanced imaging technologies, artificial intelligence (AI) in interventional cardiology, treatments for complex lesions, and the introduction of next-generation drug-eluting stents (DES).

View More On The Interventional Cardiology Devices And Equipment Market Report 2023 – https://www.thebusinessresearchcompany.com/report/interventional-cardiology-devices-and-equipment-global-market-report

Surge in Minimally Invasive Procedures Driving Market Growth

Minimally Invasive Procedures Defined

The increasing adoption of minimally invasive procedures stands out as a significant catalyst for the growth of the interventional cardiology devices and equipment market. Minimally invasive procedures involve medical techniques characterized by small incisions, fine instruments, and advanced imaging technology. These procedures aim to diagnose, treat, or perform surgery within the body with reduced risk and invasiveness compared to traditional open-heart surgery.

Benefits and Adoption Statistics

The advantages of minimally invasive procedures are evident in the rising numbers. For instance, in January 2023, Intuitive Surgical Inc. reported a noteworthy 18% increase in surgical procedures conducted using the Vinci Surgical System compared to the previous year. This surge in adoption showcases the growing preference for less invasive methods, subsequently propelling the demand for interventional cardiology devices and equipment.

Key Players in the Market

Major companies contributing to the growth of the interventional cardiology devices and equipment market include:

- GE Healthcare

- Abbott Laboratories

- Boston Scientific Corporation

- Medtronic Inc.

- Johnson & Johnson

- Braun Melsungen AG

- Biosensors International Ltd.

- Cordis Corporation

- MicroPort Scientific Corporation

- Asahi Intecc Co. Ltd.

- AngioDynamics

- R. Bard Inc.

- Contego Medical LLC

- Shockwave Medical Inc.

Innovative OPN NC Technology Redefines Standards

Technological Innovations

To meet the surging demand for minimally invasive procedures in cardiovascular disease treatment, major companies are focusing on innovative technological products. One such advancement is the percutaneous transluminal coronary angioplasty (PTCA) with Twin-Wall technology, providing superior solutions for challenging coronary lesions.

OPN NC Catheter Launch

In February 2023, SIS Medical AG, a Switzerland-based medical company, introduced the OPN NC percutaneous transluminal coronary angioplasty (PTCA) dilatation catheter with Twin-Wall technology. This next-generation balloon catheter is designed to enhance performance in challenging coronary lesions, potentially improving outcomes for patients with coronary artery disease.

Market Segmentation

The interventional cardiology devices and equipment market is segmented based on:

- Type:

- Angioplasty Balloons

- Angioplasty Stents

- Catheters

- Plaque Modification Devices

- Other Interventional Cardiology Devices

- Age Group:

- New-born (0-30 days)

- Infant (31 days-1 year)

- Children (1-18 years)

- Adult (18+ years)

- Application:

- Hospitals

- Clinics

- Cardiac Catheterization Labs

- Ambulatory Surgical Centers

North America Leading the Way

North America emerged as the largest region in the global interventional cardiology devices and equipment market in 2023, showcasing the region’s prominence in driving market dynamics.

In conclusion, the interventional cardiology devices and equipment market’s substantial growth, driven by the surge in minimally invasive procedures and technological innovations, positions it as a crucial player in the healthcare industry. As the market continues to evolve, stakeholders can anticipate a landscape shaped by advancements in personalized medicine, telehealth integration, and cutting-edge technologies.

Request A Sample Of The Global Interventional Cardiology Devices And Equipment Market Report 2023:

https://www.thebusinessresearchcompany.com/sample_request?id=2444&type=smp