How is the Laboratory Proficiency Testing Market Poised for Growth: Trends and Opportunities Through 2034

Updated 2025 Market Reports Released: Trends, Forecasts to 2034 – Early Purchase Your Competitive Edge Today!

How has the laboratory proficiency testing market size evolved in recent years?

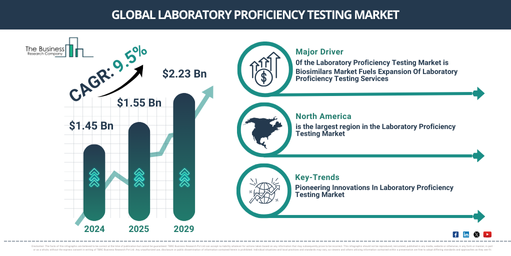

Over the past few years, the laboratory proficiency testing market has seen significant growth. The market size is projected to increase from $1.45 billion in 2024 to $1.55 billion in 2025, representing a compound annual growth rate of 7.4%. Factors driving this growth during the historical period include a focus on quality assurance, regulatory compliance obligations, specific testing requirements in the industry, the globalization of testing standards, and ongoing professional development.

What are the predictions for the laboratory proficiency testing market size in the coming years?

The size of the laboratory proficiency testing market is projected to experience robust growth in the following years, reaching up to “$2.23 billion by 2029 with a Compound Annual Growth Rate (CAGR) of 9.5%. This growth during the forecasted timeframe can be ascribed to the incorporation of artificial intelligence, ongoing professional advancement, a focus on quality assurance, an increasing need for precise testing, and the universal standardization of quality. Key trends for the forecast period include the shift towards digital and online testing, personalized testing programs, a spotlight on data analysis, a growing demand for accreditation, and quality enhancement efforts.

Get your laboratory proficiency testing market report here!

What key factors are fueling the growth of the laboratory proficiency testing market?

The laboratory proficiency testing market’s expansion is predicted to be fueled by the growth in the biosimilars market. Biosimilars are essentially identical replicas of biologic medicinal products produced by different companies. As the biosimilar market grows, the demand for analytical and bioanalytical testing of these products will augment, which in turn, will enhance the need for laboratory proficiency testing services to validate the test results for their accuracy and reliability. IQVIA, a U.S.-based organization, delivering commercial outsourcing and biopharmaceutical development services, affirms that the value of biosimilars rose at a CAGR of 78% from 2015 to 2020, reaching nearly $17.9 billion in 2020. This value is anticipated to grow at a 15% CAGR from 2020 to 2030, achieving an approximate worth of $75 billion in the subsequent decade. The anticipated loss of protection (LOP) instances for original pharmaceutical products will primarily contribute to the volume boost of biosimilars in the coming decade. Consequently, the expansion in the biosimilars market is catalyzing the growth of the laboratory proficiency testing market.

How is the global laboratory proficiency testing market divided into key segments?

The laboratory proficiency testing market covered in this report is segmented –

1) By Technology: Cell Culture, PCR, Immunoassays, Chromatography, Spectrophotometry, Other Technologies

2) By Test: Routine, Specialty

3) By Department: Parasitology, Virology, Hematology, Toxicology, Immunology/Serology, Histopathology, Urinalysis, Other Departments

4) By End-use: Hospitals, Contract Research Organizations, Pharmaceutical & Biotechnology Companies, Academic Research, Diagnostic Laboratories, Independent Laboratories, Specialty Laboratories

Subsegments:

1) By Cell Culture: Adherent Cell Culture, Suspension Cell Culture

2) By PCR (Polymerase Chain Reaction): Quantitative PCR (qPCR), Reverse Transcription PCR (RT-PCR), Digital PCR

3) By Immunoassays: Enzyme-Linked Immunosorbent Assay (ELISA), Radioimmunoassay (RIA), Chemiluminescent Immunoassay (CLIA)

4) By Chromatography: Liquid Chromatography, Gas Chromatography, Ion Chromatography

5) By Spectrophotometry: Ultraviolet-Visible Spectrophotometry, Infrared Spectrophotometry, Atomic Absorption Spectrophotometry

6) By Other Technologies: Mass Spectrometry, Flow Cytometry, Next-Generation Sequencing (NGS)

Get your free sample now – explore exclusive market insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=10518&type=smp

Who are the key firms paving the way for growth in the laboratory proficiency testing market?

Major companies operating in the laboratory proficiency testing market include LGC Limited, American Proficiency Institute, College of American Pathologists, Bio-Rad Laboratories, Randox Laboratories, Merck KGAA, FAPAS, Waters Corporation, QACS International Pvt. Ltd., Wales External Quality Assessment Scheme, AOAC INTERNATIONAL, Bureau Interprofessionnel d’Études Analytiques., SPEX CertiPrep Group LLC, Absolute Standards Inc, Trilogy Analytical Laboratories, Advanced Analytical Solutions, NSI Lab Solutions, INSTAND e.V., Anresco Laboratories, Avomeen Analytical Services, BioScreen Testing Services Inc., Brooks Applied Labs, Comprehensive Pain and Treatment Center, EMSL Analytical Inc., Eurofins Scientific SE, Exova Group Limited, Food Safety Net Services LLC, Analytical Laboratory Services Inc., Singapore Accreditation Council, Proctor & Allan East Africa Limited

Which trends are expected to transform the laboratory proficiency testing market?

Product innovations are emerging as a leading trend in the laboratory proficiency testing market. To maintain their market position, major companies in this field are releasing new and unique products. For example, BIPEA, a non-profit organization based in Europe that provides proficiency tests for food and environmental samples, introduced PT 35d in February 2022. This is a proficiency testing scheme tailored for water microbiological testing labs, emphasizing the counting of yeasts and molds in fresh water. The initiative includes two stages, with rapid delivery services ensuring two chilled water samples reach participating labs during each stage.

Unlock exclusive market insights – purchase your research report now for a swift delivery!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=10518

What regions are contributing significantly to the growth of the laboratory proficiency testing market?

North America was the largest region in the laboratory proficiency testing market in 2024.Asia-Pacific is expected to be the fastest-growing region in the global laboratory proficiency testing market report during the forecast period. The regions covered in the laboratory proficiency testing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Browse Through More Similar Reports By The Business Research Company:

Laboratory Centrifuge Global Market Report 2024

https://www.thebusinessresearchcompany.com/report/laboratory-centrifuge-global-market-report

Analytical Laboratory Instrument Global Market Report 2024

Veterinary Reference Laboratory Global Market Report 2024

About The Business Research Company:

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead in the game.

Contact us at:

The Business Research Company: https://www.thebusinessresearchcompany.com/

Americas +1 3156230293

Asia +44 2071930708

Europe +44 2071930708

Email us at info@tbrc.info

Follow us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

Found this article helpful? Share it on: