5 Takeaways From The Medical Styrenic Block Copolymer Market Overview 2024

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2024 and forecasted to 2033

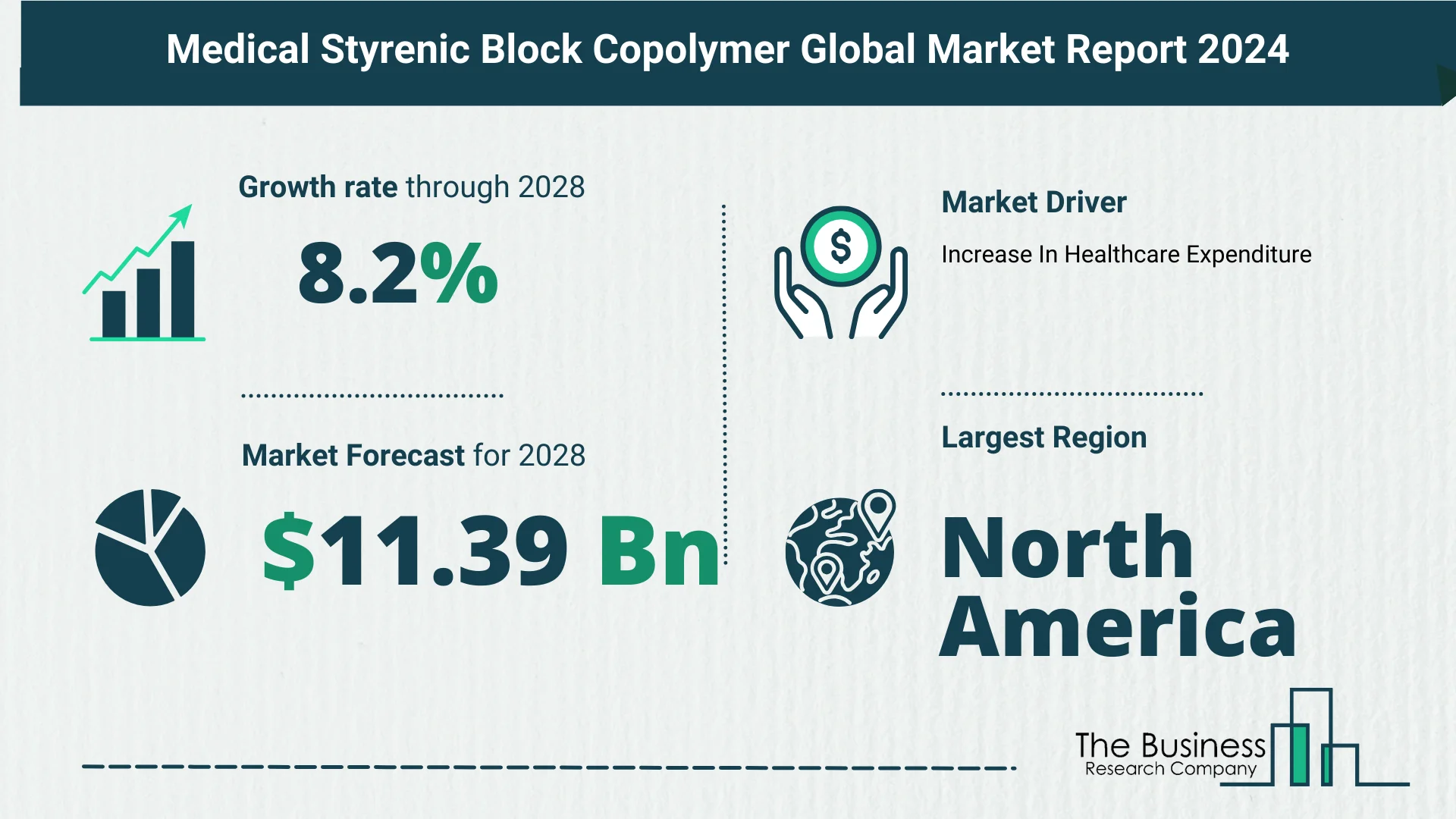

According to The Business Research Company’s Medical Styrenic Block Copolymer Global Market Report 2024, the medical styrene block copolymer market is expected to show promising growth in the forecast period.

The medical styrenic block copolymer market has experienced robust growth, increasing from $7.71 billion in 2023 to a projected $8.33 billion in 2024, reflecting a Compound Annual Growth Rate (CAGR) of 8.1%. The growth in the historic period can be attributed to factors such as regulatory compliance, infection control, telemedicine services, precision medicine, and global healthcare initiatives.

- Impact of Increasing Healthcare Expenditure: The growth of the medical styrenic block copolymer market is closely linked to the rise in healthcare expenditure globally. The average spending on healthcare in economies, including India and the United States, has increased significantly. These funds contribute to the production of medical products utilizing styrene block copolymers, enhancing flexibility and elasticity.

- Global Healthcare Spending: Notably, Indian public spending on healthcare reached 2.1% of GDP in 2022, up from 1.8% in 2021. In the U.S., healthcare spending rose by 9.7% in 2020, reaching a staggering $4.1 trillion. The substantial increase in healthcare expenditure underlines the importance of medical styrenic block copolymers in supporting the demand for high-quality materials.

- Market Players: Major companies driving this growth include Zeon Corporation, TSRC Corporation, Kumho Petrochemical Co. Ltd., and INEOS Styrolution Group GmbH, among others. These entities play a pivotal role in meeting the rising demand for medical styrenic block copolymers.

Increasing Focus On Introducing Expanding Production To Gain A Competitive Edge

Companies operating in the medical styrenic block copolymer market are strategically focusing on expanding production to gain a competitive edge. This approach ensures a steady supply of high-quality materials for medical devices and packaging, aligning with the escalating healthcare demands globally.

- Strategic Production Expansion: Notable examples include China Petroleum & Chemical Corporation’s launch of a styrene-butadiene copolymer (SBC) project in Hainan, China. With an annual production capacity of 170,000 tons, Sinopec positions itself as the largest global producer of SBC plants, meeting the surging demand for medical styrenic block copolymers.

View More On The Medical Styrenic Block Copolymer Market Report 2024 – https://www.thebusinessresearchcompany.com/report/medical-styrenic-block-copolymer-global-market-report

DL Chemicals Acquired Karton: Fueling Innovation and Growth

In December 2021, DL Chemicals, a South Korea-based company specializing in medical polyethylene and elastomer polybutylene products, acquired Karton for a significant deal amount of $2.5 billion. This strategic move provides DL Chemicals with financial strength and a growth-oriented focus, enabling Kraton Corporation, a US-based company specializing in high-performance elastomers and medical styrenic block copolymers, to invest in innovations and develop new technological products.

- Strategic Acquisition for Growth: DL Chemicals’ acquisition of Karton reinforces the trend of strategic acquisitions in the medical styrenic block copolymer market. This not only enhances DL Chemicals’ capabilities but also positions Kraton Corporation to strengthen its position as a leader in high-performance elastomers.

Market Segmentation: Understanding Diverse Applications

The medical styrenic block copolymer market is segmented based on type and application, providing a comprehensive overview of its diverse applications within the medical field.

- Type Segmentation: Styrene Ethylene Butadiene Styrene, Styrene Isoprene Butadiene, Styrene-Butadiene-Styrene.

- Application Segmentation: Tubing, Medical bags, Equipment, Packaging and diagnostics products, Wound care, Other Applications.

- Regional Dominance: North America emerged as the largest region in the medical styrenic block copolymer market in 2023, with Asia-Pacific anticipated to be the fastest-growing region in the forecast period. This highlights the global nature of the market and the need for these materials on a global scale.

In conclusion, the medical styrenic block copolymer market’s trajectory is marked by the essential role it plays in responding to the rising healthcare expenditure, strategic production expansions, and key acquisitions. As healthcare demands continue to grow, these trends are set to shape the market’s future, ensuring the supply of innovative and high-quality materials for medical applications.

Request A Sample Of The Global Medical Styrenic Block Copolymer Market Report 2024:

https://www.thebusinessresearchcompany.com/sample_request?id=6582&type=smp