Future Outlook of the Medical Tubing Market: Growth, Trends, and Emerging Opportunities Explored

Updated 2025 Market Reports Released: Trends, Forecasts to 2034 – Early Purchase Your Competitive Edge Today!

How has the medical tubing market size evolved in recent years?

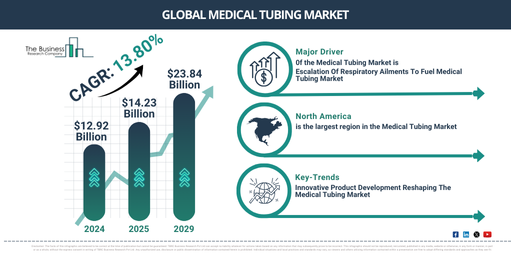

The market size for medical tubing has seen swift expansion in the past few years. Its growth trajectory indicates an increase from $12.92 billion in 2024 to $14.23 billion in 2025, boasting a compound annual growth rate (CAGR) of 10.2%. This growth during the previous years is due to factors such as medical device production, infection management, cardiovascular operations, surgical applications, as well as miniaturization and microfluidics.

What are the predictions for the medical tubing market size in the coming years?

In the coming years, a swift expansion is anticipated in the medical tubing market size, reaching a value of $23.84 billion by 2029, exhibiting an impressive CAGR of 13.8%. The progression in the forecast timeline can be ascribed to multiple factors such as the advent of precision medicine, telemedicine services, the use of biodegradable materials, global health drives, and the aging population. Major trends during this forecast period encompass neurology and brain monitoring, innovation in drug delivery, advancements in diagnostic methods, biocompatibility, and tissue engineering.

Get your medical tubing market report here!

https://www.thebusinessresearchcompany.com/report/medical-tubing-global-market-report

What key factors are fueling the growth of the medical tubing market?

The medical tubing market’s expansion is being fueled by escalating instances of respiratory illnesses. Such diseases, including asthma, lung cancer, pulmonary fibrosis, among others, are usually triggered by factors like tobacco smoking, air contamination, allergens, and job-related hazards. An upsurge in respiratory diseases is set to boost the need for medical tubes as they play a crucial role in ventilators, aiding breathing. For example, as per data by the Centers for Disease Control and Prevention, a government agency based in the US, tuberculosis cases amplified from 8,320 in 2022 to 9,615 in 2023; this portrayed a growth of 1,295 cases. The rate of incidence also rose; from 2.5 per 100,000 people in 2022 to 2.9 in 2023. Thus, the burgeoning episodes of respiratory illnesses will stimulate the expansion of the medical tubing market.

How is the global medical tubing market divided into key segments?

The medical tubing market covered in this report is segmented –

1) By Product: Silicone, Polyolefins, Polyvinyl Chloride, Polycarbonates, Fluoropolymers, Other Products

2) By Application: Bulk Disposable Tubing, Drug Delivery Systems, Catheters, Biopharmaceutical Laboratory Equipment, Other Applications

3) By End-User: Hospitals, Clinics, Ambulatory Surgical Centers, Medical Labs, Other End-Users

Subsegments:

1) By Silicone: Medical Grade Silicone Tubing, Reinforced Silicone Tubing

2) By Polyolefins: Polyethylene (PE) Tubing, Polypropylene (PP) Tubing

3) By Polyvinyl Chloride (PVC): Flexible PVC Tubing, Rigid PVC Tubing

4) By Polycarbonates: Clear Polycarbonate Tubing, Specialty Polycarbonate Tubing

5) By Fluoropolymers: Polytetrafluoroethylene (PTFE) Tubing, Fluorinated Ethylene Propylene (FEP) Tubing

6) By Other Products: Thermoplastic Elastomers (TPE) Tubing, Nylon Tubing, Custom Extruded Tubing

Get your free sample now – explore exclusive market insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=6688&type=smp

Who are the key firms paving the way for growth in the medical tubing market?

Major companies operating in the medical tubing market include Saint-Gobain S.A., Freudenberg Medical LLC, W.L. Gore & Associates Inc., Avient Corporation, Raumedic AG, Micro-Tek Corp., NewAge Industries Inc., Axiom Medical Inc., NovoSci Corp., Vanguard Products Corp., Zeus Industrial Products Inc., Absolute Custom Extrusions Inc., Petro Extrusion Technologies Inc., Pexco LLC, GSH Industries Inc., Teleflex Medical OEM LLC, Putnam Plastics Corporation, Tekni-Plex Inc., Nordson Corporation, Qosina Corp., Vesta Inc., Lubrizol Life Science Health, Grayline LLC, Trelleborg Healthcare & Medical, Spectrum Plastics Group Inc., Merit Medical Systems Inc., Applied Plastics Co. Inc., Duke Empirical Inc., Biomerics LLC, Polyzen Inc., Resonetics LLC

Which trends are expected to transform the medical tubing market?

The medical tubing market is increasingly gravitating towards product innovation, a leading trend. Industry pioneers are concentrating on introducing novel and enhanced medical tubes with advanced characteristics to enhance usage outcomes. They’re heavily relying on cutting-edge manufacturing techniques and up-to-date technologies to roll out distinctive, practical medical tubes designed for efficiency. The uniquely designed braided medical tube stands out as one of the latest additions to this innovation wave. Its design uniqueness offers and broadens the potential of catheters and medical tubing. This braided tube solution significantly boosts the durability and flexibility of existing medical machinery. It finds application in a range of medical procedures, including cardiovascular and neurovascular surgery, alongside endoscopic treatments involving the gastrointestinal digestive system. For example, in October 2023, SCHOTT AG, a German glass enterprise, unveiled FIOLAX Pro. This is an upgraded variant of borosilicate glass tubing crafted for the pharmaceutical industry, aligning with vital industry trends such as intricate pharmaceuticals, sustainable products’ surge, and the shift towards digitization. FIOLAX Pro boasts strict dimensional precision, improving the accuracy of pharmaceutical filling processes in syringes and cartridges, thereby minimizing overfill losses while enhancing dosage precision.

Unlock exclusive market insights – purchase your research report now for a swift delivery!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=6688

What regions are contributing significantly to the growth of the medical tubing market?

North America was the largest region in the medical tubing market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the medical tubing market report include Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa.

Browse Through More Similar Reports By The Business Research Company:

Network Engineering Services Global Market Report 2024

https://www.thebusinessresearchcompany.com/report/network-engineering-services-global-market-report

Power Generators Global Market Report 2023

https://www.thebusinessresearchcompany.com/report/power-generators-global-market-report

IoT in Manufacturing Global Market Report 2024

https://www.thebusinessresearchcompany.com/report/iot-in-manufacturing-global-market-report

About The Business Research Company:

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead in the game.

Contact us at:

The Business Research Company: https://www.thebusinessresearchcompany.com/

Americas +1 3156230293

Asia +44 2071930708

Europe +44 2071930708

Email us at [email protected]

Follow us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

Found this article helpful? Share it on: