Comprehensive Analysis On Size, Share, And Drivers Of The Operating Room Integration Market

The Business Research Company’s global market reports provide comprehensive analysis on the various markets in 27 industries across 60 geographies.

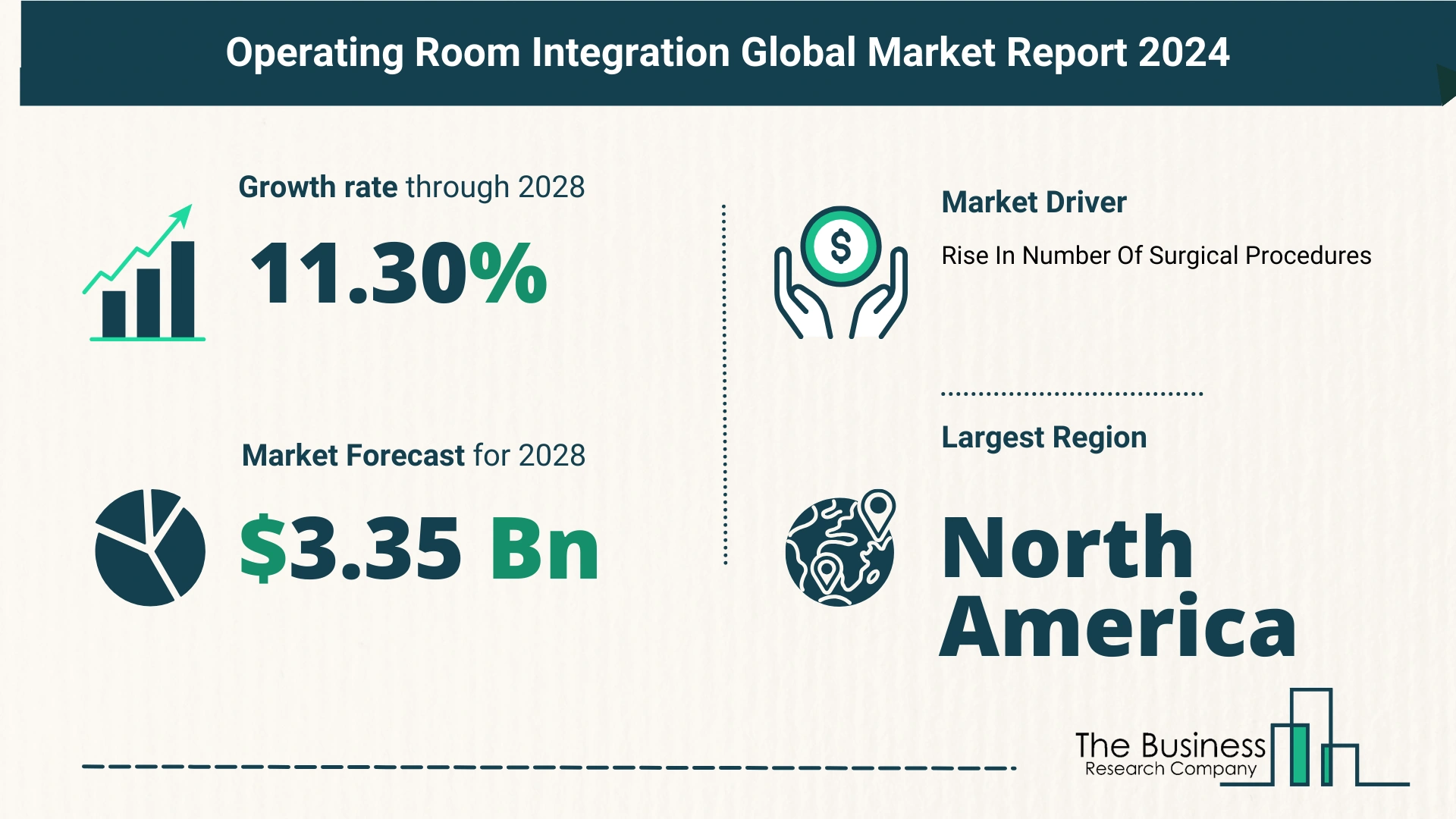

Overview of Market Growth

- The operating room integration market size has grown rapidly in recent years.

- Growth from $1.93 billion in 2023 to $2.18 billion in 2024 at a CAGR of 13.1%.

- Factors driving growth: healthcare infrastructure development, shift towards minimally invasive surgical techniques, increasing complexity of surgical procedures.

Future Market Projections

- The market is expected to see rapid growth in the next few years.

- Projected growth to $3.35 billion in 2028 at a CAGR of 11.3%.

- Key drivers: integration of robotic-assisted surgery and AI, adoption of telemedicine and remote healthcare solutions, increased focus on infection control and patient safety, emphasis on data-driven decision-making in healthcare.

Major Trends Shaping the Market

- Advancements in medical imaging technologies.

- Development of digital imaging systems.

- Minimally invasive surgery techniques.

- Improved diagnostic tools.

View More On The Operating Room Integration Market Report 2024 – https://www.thebusinessresearchcompany.com/report/operating-room-integration-global-market-report

Surgical Procedure Surge Propels Market Growth

- Increasing number of surgical procedures drives market growth.

- Surgical procedures are essential for treating various diseases and disorders through invasive methods.

- Operating room integration enhances precision and safety, improving surgical outcomes.

- Example: In 2022, plastic surgeons performed approximately 14.9 million surgical and 18.8 million non-surgical procedures globally, an 11.2% rise in total procedures (ISAPS).

Key Market Players

- Major companies in the market:

- Johnson & Johnson

- Sony Electronics Inc.

- Siemens Healthineers

- Fujifilm Holdings Corporation

- Stryker Corporation

- GE Healthcare

- Zimmer Biomet Holdings Inc.

- Olympus Corporation

- Smith & Nephew plc

- Steris Corporation

- Merivaara Corporation

- Optovue Inc.

- IntegriTech

Advanced Visualization and Integration Solutions

- Focus on advanced technological solutions to gain a competitive edge.

- Visualization and integration solutions provide a unified view of diverse data, aiding decision-making.

- Example: In July 2023, Olympus Corporation launched the EasySuite ES-IP system, a modular, scalable, workflow-based visualization and integration solution for operating rooms.

Significant Acquisition in the Market

- Stryker Corporation’s acquisition of Vocera Communications.

- In February 2022, Stryker acquired Vocera Communications for $3 billion.

- The acquisition enhances Stryker’s digital healthcare offerings, including operating room integration and digital care coordination.

Market Segmentation

- By Component: Software, Services.

- By Device Type: Audio Video Management System, Display System.

- By Application: General Surgery, Orthopedic Surgery, Cardiovascular Surgery, Neurosurgery.

- By End-use: Hospitals, Ambulatory Surgical Centers.

Regional Insights

- North America was the largest region in the operating room integration market in 2023.

- Asia-Pacific is expected to be the fastest-growing region in the forecast period.

The operating room integration market is poised for significant growth, driven by technological advancements, increasing surgical procedures, and strategic acquisitions. As healthcare continues to evolve, the integration of advanced systems and solutions will play a critical role in enhancing patient care and operational efficiency.

Request A Sample Of The Global Operating Room Integration Market Report 2024:

https://www.thebusinessresearchcompany.com/sample_request?id=13893&type=smp