Refurbished Medical Imaging Devices Market Report 2024: Market Size, Drivers, And Trends

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2024 and forecasted to 2033

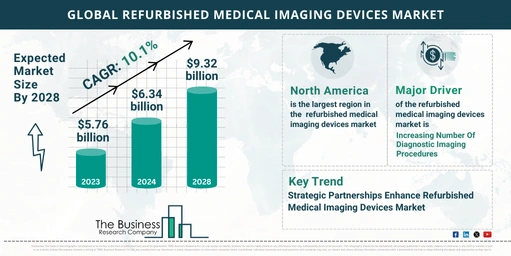

The refurbished medical imaging devices market is on a robust growth trajectory, driven by several key factors. From 2023 to 2024, the market is projected to expand from $5.76 billion to $6.34 billion, reflecting a 10% compound annual growth rate (CAGR). Looking further ahead, the market is anticipated to reach $9.33 billion by 2028, growing at a CAGR of 10.1%. This blog explores the current trends, driving factors, and key players shaping the future of the refurbished medical imaging devices market.

Growth Drivers

- Healthcare Reimbursement Policies: Favorable reimbursement policies are boosting the adoption of refurbished medical imaging devices. These policies make it more financially feasible for healthcare providers to invest in high-quality imaging equipment.

- Clinical Needs and Vendor Support: Increasing clinical needs and vendor support are contributing to the market growth. The demand for high-quality diagnostic imaging solutions drives the refurbishment and reuse of existing equipment.

- Patient Safety and Quality of Care: Enhanced focus on patient safety and quality of care ensures that refurbished devices meet rigorous standards, thereby encouraging their adoption.

- Vendor Dynamics and Service Quality: The dynamics of vendor support and service quality play a crucial role in the growth of the market. High service standards and reliable support enhance the appeal of refurbished imaging devices.

Future Growth Projections

- Healthcare Infrastructure Development: The expansion of healthcare infrastructure globally is driving the demand for refurbished medical imaging devices. New and upgraded facilities require cost-effective imaging solutions.

- Increasing Demand for Diagnostic Services: The growing need for diagnostic services and specialized imaging modalities is fueling the market. Replacement cycles and obsolescence are also key factors.

- Enhanced Connectivity and Interoperability: Trends such as improved connectivity and interoperability in medical devices are shaping the market. Portable and point-of-care solutions are gaining popularity due to their convenience and effectiveness.

- Cost-Effectiveness and Sustainability: Emphasis on cost-effectiveness and sustainability is driving the adoption of refurbished devices. Upgradability and modularity further enhance their appeal.

- Compliance and Quality Assurance: Ensuring compliance with regulatory standards and maintaining high-quality assurance are critical factors that support market growth.

View More On The Refurbished Medical Imaging Devices Market Report 2024 – https://www.thebusinessresearchcompany.com/report/refurbished-medical-imaging-devices-global-market-report

Increasing Diagnostic Imaging Procedures

- Rise in Preventive Healthcare: The adoption of preventive healthcare measures is increasing the number of diagnostic imaging procedures. Refurbished devices play a significant role in providing accessible and reliable diagnostic services.

- Statistics and Growth: According to a December 2023 report, the number of MRI units in Canada saw a 30.8% increase from 2021 to 2022. Additionally, the average number of MRI scans per facility increased, highlighting the growing demand for imaging services.

Key Players and Strategic Moves

- Major Companies: Key players in the refurbished medical imaging devices market include Hitachi Ltd., Siemens Healthineers AG, Philips N.V., GE Healthcare LLC, and Canon Medical Systems Corporation, among others.

- Strategic Partnerships: Companies are forming strategic partnerships to enhance their market presence. For instance, AA Medical’s partnerships with Tekyard, Zantek Medical, and MED-SELL.COM aim to expand their global reach and capabilities.

- Probo Medical Acquisition: In February 2024, Probo Medical acquired Alpha Source Group to bolster its services. This acquisition enhances Probo Medical’s capabilities in equipment refurbishment and technical field services.

Market Segmentation

- By Product: The market is segmented into X-Ray Machines, MRI Systems, Ultrasound Systems, Computed Tomography Scanners, Nuclear Imaging Systems, and Other Products.

- By Application: Refurbished medical imaging devices are used for Diagnostic and Therapeutic applications.

- By End Users: The end-users of refurbished medical imaging devices include Hospitals, Clinics, Diagnostic Centers, and Other End Users.

Regional Insights

- North America: In 2023, North America was the largest market for refurbished medical imaging devices, driven by advanced healthcare infrastructure and high demand.

- Asia-Pacific: Asia-Pacific is expected to be the fastest-growing region during the forecast period, fueled by increasing healthcare investments and rising diagnostic needs.

The refurbished medical imaging devices market is set for continued growth, driven by increasing diagnostic procedures, technological advancements, and strategic industry partnerships. As healthcare facilities seek cost-effective and reliable imaging solutions, the market for refurbished devices will continue to expand, offering valuable opportunities for industry stakeholders.

Request A Sample Of The Global Refurbished Medical Imaging Devices Market Report 2024:

https://www.thebusinessresearchcompany.com/sample_request?id=15915&type=smp