Residential Intellectual And Development Disability Care Market Analysis: Key Insights on Growth Rates, Trends, and Major Opportunities

Updated 2025 Market Reports Released: Trends, Forecasts to 2034 – Early Purchase Your Competitive Edge Today!

What fueled the previous growth in the residential intellectual and development disability care market?

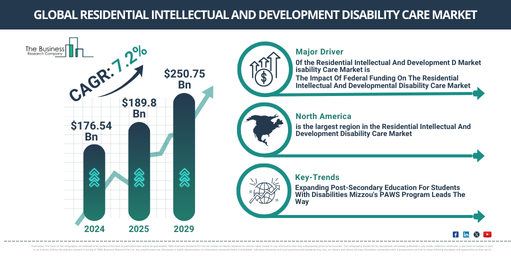

The residential intellectual and developmental disability care market has grown substantially, with its size expected to rise from $176.54 billion in 2024 to $189.8 billion in 2025 at a CAGR of 7.5%. Key contributors to past growth include increased diagnosis and awareness, expanded government funding and support programs, advancements in care standards, an aging population, and rising private investments in the sector.

What will be the residential intellectual and development disability care market size in the future?

The residential intellectual and developmental disability care market is forecasted to grow substantially, reaching $250.75 billion by 2029 at a CAGR of 7.2%. Growth will be driven by a shift toward personalized care, workforce development, increasing demand for specialized services, regulatory changes, and the expansion of community-based care options. Key trends include advanced technology integration, increased collaborations, workforce training, incorporation of behavioral health services, and the use of data analytics and electronic health records.

Get your residential intellectual and development disability care market report here!

What main drivers are fueling expansion in the residential intellectual and development disability care market?

Increased federal funding for programs supporting individuals with intellectual disabilities is expected to boost the residential intellectual and developmental disability care market. The growth in federal funding is driven by heightened awareness, advocacy for better services, and policies aimed at improving the quality of life and providing equal opportunities. This funding enhances residential care by improving service delivery, support, and infrastructure. For instance, in December 2022, Education Week reported that federal spending on special education through the Individuals with Disabilities Education Act (IDEA) rose from $13 billion to $15.5 billion for the period from October 2022 to September 2023. Additionally, in September 2023, the U.S. Department of Health and Human Services invested $8 million to improve caregiver training in this sector. Thus, increased federal funding is fueling market growth.

What key areas define the segmentation of the global residential intellectual and development disability care market?

The residential intellectual and development disability caremarket covered in this report is segmented –

1) By Indication: Attention-Deficit Or Hyperactivity Disorder (ADHD), Autism Spectrum Disorders, Intellectual Disability, Learning Disorders, Other Indications

2) By Mode Of Operation: State-Run Facilities, Medicaid Funded Services, Private Large Facilities, Privately Run Small Facilities

3) By Number Of Beds: 4 To 9, 10 To 19, 20 To 49, 50 To 99, 100 To 199, 200 And More Beds

4) By End User: Hospitals, Intermediate Care Facilities, Group Homes, Private Home, Intellectual And Developmental Disability Facilities

Subsegments:

1) Attention-Deficit Or Hyperactivity Disorder (ADHD): Behavioral Therapy, Medication Management, Support Services

2) Autism Spectrum Disorders: Applied Behavior Analysis (ABA) Therapy, Social Skills Training, Speech Therapy

3) Intellectual Disability: Residential Support Services, Day Programs, Vocational Training

4) Learning Disorders: Educational Support Services, Tutoring Programs, Skill Development Workshops

5) Other Indications: Dual Diagnosis Support, Mental Health Services, Therapeutic Recreation Programs

Get your free sample now – explore exclusive market insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=19678&type=smp

Who are the dominant players expanding their reach in the residential intellectual and development disability care market?

Major companies operating in the residential intellectual and development disability care market are Commonwealth of Pennsylvania, Texas Health and Human Services, Acadia Healthcare, Sheppard Pratt Health System Inc., Cerebral Palsy Associations of New York State, Merakey Allegheny Valley School, WellLife Network Inc., Alliance Health, PERFORMCARE, Texana Center, Cuyahoga County Board of Developmental Disabilities, Lutheran Family Services Rocky Mountains, The Home Care Spot., Metrocare Services, The Arc of the United States, Health Standards Organization (HSO), New Vista Nursing and Rehabilitation Center, Residential Support Services, Lutheran Services in America Inc., St. Joseph’s Center, The Commonwealth Fund, Beacon Health Options Inc., SPOT Rehabilitation & Home Health Care, Durham County Community Living Programs Inc.

How are evolving market trends shaping residential intellectual and development disability care Strategies?

Leading firms in the residential intellectual and developmental disability care market are channeling their efforts towards post-secondary education initiatives. These initiatives aim to equip students within university environments with vital life skills, job readiness, and foster social integration. Such unique programs offer academic, vocational, and life skills tutelage, assisting students with intellectual and developmental disabilities to transition seamlessly into adulthood and work life. A case in point is the University of Missouri (Mizzou) which, in January 2023, unveiled the Preparing Adults for Work and Society (PAWS) program. This residential initiative is dedicated to delivering post-secondary education prospects for such students, enhancing social integration by advocating interactions between students with disabilities and their peers. This in turn cultivates inclusivity and combats isolation. PAWS is also aiming to obtain accreditation as a Comprehensive Transition Post-Secondary (CTP) Program from the U.S. Department of Education.

Unlock exclusive market insights – purchase your research report now for a swift delivery!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=19678

Which regions are emerging as leaders in the residential intellectual and development disability care market?

North America was the largest region in the residential intellectual and development disability care market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the residential intellectual and development disability care market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Browse Through More Similar Reports By The Business Research Company:

Prenatal DNA Sequencing Global Market Report 2024

https://www.thebusinessresearchcompany.com/report/prenatal-dna-sequencing-global-market-report

Retail Clinics Global Market Report 2024

https://www.thebusinessresearchcompany.com/report/retail-clinics-global-market-report

Theranostics Global Market Report 2024

https://www.thebusinessresearchcompany.com/report/theranostics-global-market-report

About The Business Research Company:

With over 15000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead in the game.

Contact us at:

The Business Research Company: https://www.thebusinessresearchcompany.com/

Americas +1 3156230293

Asia +44 2071930708

Europe +44 2071930708

Email us at [email protected]

Follow us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

Found this article helpful? Share it on: