Global Rheumatology Therapeutics Market Analysis: Estimated Market Size And Growth Rate

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2024 and forecasted to 2033

The rheumatology therapeutics market is on a steady growth trajectory, driven by increasing prevalence of autoimmune diseases, advancements in treatment options, and expanding healthcare access. Here’s an in-depth look at the market dynamics, projections, and key trends shaping the industry.

Current Market Size and Growth

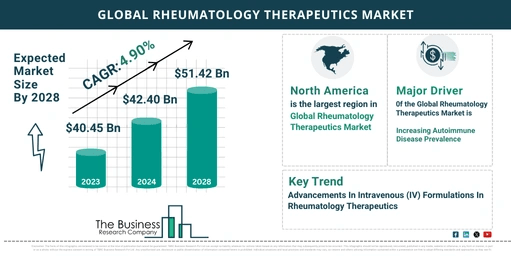

- 2023 Market Size: $40.45 billion

- 2024 Market Size (Projected): $42.40 billion

- CAGR: 4.8%

Key Growth Drivers

- Rising Prevalence of Rheumatologic Disorders: Increased incidence of autoimmune diseases drives demand for therapeutics.

- Aging Population: Global aging population contributes to higher prevalence of rheumatologic conditions.

- Growing Awareness: Increased awareness about treatment options and advancements in biological therapies.

- Expansion of Healthcare Access: Improved access to healthcare in emerging markets boosts market growth.

View More On The Rheumatology Therapeutics Market Report 2024 –

https://www.thebusinessresearchcompany.com/report/rheumatology-therapeutics-global-market-report

Future Market Growth and Trends

The rheumatology therapeutics market is expected to continue growing steadily, supported by various factors.

Forecasted Growth (2024-2028)

- CAGR: 4.9%

- 2028 Market Size (Projected): $51.42 billion

Growth Drivers

- Shift Towards Personalized Medicine: Adoption of personalized medicine approaches tailored to individual patient needs.

- Rising Adoption of Biosimilars: Increased use of biosimilars in rheumatology to enhance treatment options.

- Investment in Research and Development: Higher R&D investments lead to the development of innovative therapies.

- Integration of Digital Health Technologies: Digital tools and telemedicine enhance patient monitoring and treatment management.

- Regulatory Approvals for Novel Therapies: New therapies receive regulatory approvals, expanding treatment options.

Major Trends

- Telemedicine and Remote Monitoring Solutions: Growth in telehealth and remote patient monitoring for managing rheumatologic conditions.

- Expansion of Targeted Therapies: Development of targeted therapies for specific rheumatic conditions.

- Patient-Centric Care Models: Emphasis on care models that prioritize patient needs and outcomes.

- Biologic Treatments Beyond Monoclonal Antibodies: Expansion of biologic treatments to include newer therapeutic options.

- Value-Based Pricing Models: Adoption of pricing models focused on the value delivered by treatments.

Market Driver: Increasing Autoimmune Disease Prevalence

The growing prevalence of autoimmune diseases is a significant driver for the rheumatology therapeutics market.

Key Statistics

- June 2024: According to the Australian Institute of Health and Welfare, approximately 514,000 people in Australia were estimated to have rheumatoid arthritis in 2022, accounting for 2.0% of the total population and 16% of the burden for all musculoskeletal conditions.

Major Players in the Global Market

Leading companies in the rheumatology therapeutics market are driving innovation and expanding their market presence.

Key Companies

- Pfizer Inc.

- Johnson & Johnson

- Roche Holding AG

- Merck & Co. Inc.

- AbbVie Inc.

- Sanofi SA

- Janssen Biotech

- Regeneron Pharmaceuticals Inc.

- Biogen Inc.

- Vertex Pharmaceuticals

- UCB S.A.

- Galapagos NV (GLPG)

- Genentech Inc.

Innovations and Strategic Investments

Key players are focusing on advancements and strategic acquisitions to strengthen their market positions.

Example: Novartis AG

- October 2023: Announced FDA approval for Cosentyx, an intravenous (IV) formulation for treating psoriatic arthritis, ankylosing spondylitis, and non-radiographic axial spondyloarthritis. This formulation targets interleukin-17A (IL-17A) and is the only non-TNF-alpha IV treatment available for these conditions.

Example: Alfasigma S.p.A.

- February 2024: Acquired Jyseleca (filgotinib) from Galapagos NV for $184.54 million. This acquisition expands Alfasigma’s product portfolio in gastrointestinal and rheumatological treatments and enhances its presence in European markets.

Market Segmentation

The rheumatology therapeutics market is segmented into various categories:

- By Drug Class:

- Disease Modifying Anti-Rheumatic Drugs (DMARDs)

- Nonsteroidal Anti-Inflammatory Drugs (NSAIDs)

- Corticosteroids

- Uric Acid Drugs

- Other Drug Classes

- By Distribution Channel:

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- By Disease Indication:

- Rheumatoid Arthritis

- Osteoarthritis

- Gout

- Psoriatic Arthritis

- Ankylosing Spondylitis

- Other Disease Indications

Regional Insights

Regional dynamics highlight North America as the largest market, with significant growth potential in other regions.

Regional Market Leaders

- North America: The largest region in the rheumatology therapeutics market in 2023, driven by advanced healthcare infrastructure and high treatment adoption rates.

- Asia-Pacific: Expected to be the fastest-growing region during the forecast period due to expanding healthcare infrastructure and rising prevalence of rheumatologic disorders.

Request A Sample Of The Global Rheumatology Therapeutics Market Report 2024:

https://www.thebusinessresearchcompany.com/sample_request?id=17246&type=smp