Growth Trajectory Of The Surgical Tables Market 2024-2033

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2024 and forecasted to 2033

The surgical tables market is experiencing robust growth, driven by increasing surgical procedures, advancements in medical technology, and expanding healthcare infrastructure. Here’s a comprehensive overview of the market dynamics, growth projections, and major trends.

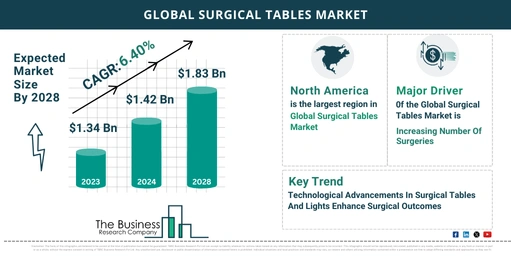

Current Market Size and Growth

- 2023 Market Size: $1.34 billion

- 2024 Market Size (Projected): $1.42 billion

- CAGR: 6.1%

Key Growth Drivers

- Increased Hospital Admissions: More admissions lead to a higher demand for surgical tables.

- Growth in Medical Tourism: Rising medical tourism boosts the need for advanced surgical facilities.

- Awareness of Minimally Invasive Surgeries: Increased preference for minimally invasive procedures requires specialized tables.

- Focus on Patient Safety: Enhanced safety protocols drive the demand for reliable surgical equipment.

- Growth in Outpatient Surgeries: The rise in outpatient procedures increases the need for versatile surgical tables.

View More On The Surgical Tables Market Report 2024 –

https://www.thebusinessresearchcompany.com/report/surgical-tables-global-market-report

Future Market Growth and Trends

The surgical tables market is projected to continue its strong growth trajectory, supported by various factors.

Forecasted Growth (2024-2028)

- CAGR: 6.4%

- 2028 Market Size (Projected): $1.83 billion

Growth Drivers

- Increasing Incidence of Cardiovascular Disorders: More cardiovascular surgeries drive demand for advanced tables.

- Rising Number of Surgeries: More surgeries increase the need for efficient and versatile surgical tables.

- Demand for Hybrid Operating Rooms: Integration of imaging technologies in hybrid operating rooms drives innovation.

- Rising Disposable Income: Higher disposable income supports the adoption of advanced surgical equipment.

- Expanding Healthcare Infrastructure: Growth in healthcare facilities contributes to increased demand for surgical tables.

Major Trends

- Technological Advancements: Innovations in surgical table design and functionality.

- Integration of Imaging Technologies: Improved imaging compatibility enhances surgical precision.

- Motorized and Automated Systems: Enhanced automation improves efficiency and ease of use.

- Hybrid Operating Rooms: Demand for versatile tables that support hybrid operating room setups.

- Ergonomic Designs: Focus on ergonomic designs for improved surgeon comfort and patient positioning.

Market Driver: Increasing Number of Surgeries

The rising number of surgeries is a significant driver for the surgical tables market. Factors contributing to this include:

- Aging Population: An older demographic requires more surgical interventions.

- Advancements in Medical Technology: New technologies lead to more procedures.

- Improved Access to Healthcare: Enhanced healthcare access increases the number of surgeries.

- Higher Demand for Elective Procedures: Increased patient demand for elective surgeries.

Example: Australian Institute of Health and Welfare

- November 2023: Reported a significant increase in elective surgeries, with 735,500 individuals admitted from public hospital waiting lists in 2022–2023, an 18% increase from the previous year.

Major Players in the Global Market

Leading companies in the surgical tables market are driving innovation and market expansion.

Key Companies

- Stryker Corporation

- Baxter International Inc.

- STERIS Corporation

- Getinge AB

- Hillrom Holdings Inc.

- Alvo Medical

- Mizuho OSI

- AMTAI Medical Equipment Inc.

- Allen Medical Systems

- NUVO Surgical

- OPT SurgiSystems Srl

- Schaerer Medical AG

- Infinium Medical

- TRUMPF Medizin Systeme GmbH Co. KG

Innovations and Strategic Investments

Key players are focusing on technological advancements and strategic acquisitions to enhance their market position.

Example: Mediland Enterprise Corporation

- March 2021: Launched the C800 electro-hydraulic operating table and SunLED Series surgical light, featuring advanced controls, imaging clarity, and ergonomic design.

Example: Baxter International Inc.

- December 2021: Acquired Hill-Rom Holdings Inc. for approximately $12.5 billion, expanding its portfolio in connected care and surgical tables.

Market Segmentation

The surgical tables market is segmented into various categories:

- By Product:

- General

- Specialty

- Pediatric

- Radiolucent

- By Device Type:

- Powered

- Non-Powered

- By Material:

- Metal

- Composite

- By End-Use:

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Other End-Users

Regional Insights

Regional dynamics highlight North America as the largest market, with significant growth potential in other regions.

Regional Market Leaders

- North America: The largest region in the surgical tables market in 2023, driven by advanced healthcare infrastructure and high adoption rates.

- Asia-Pacific: Expected to be the fastest-growing region during the forecast period due to expanding healthcare infrastructure and rising medical tourism.

Request A Sample Of The Global Surgical Tables Market Report 2024:

https://www.thebusinessresearchcompany.com/sample_request?id=17273&type=smp