Top 5 Insights From The Tumor Embolization Devices Market Report 2024

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2024 and forecasted to 2033

According to The Business Research Company’s Tumor Embolization Devices Global Market Report 2024, the tumor embolization devices market is expected to show promising growth in the forecast period.

The tumor embolization devices market has witnessed rapid growth, surging from $1.62 billion in 2023 to a projected $1.82 billion in 2024, reflecting a remarkable Compound Annual Growth Rate (CAGR) of 12.8%. This surge in the historic period is attributed to several factors that have fueled the market’s expansion.

- Minimally Invasive Procedures

- Technological Advancements

- Cancer Incidence

- Aging Population

Anticipating Rapid Growth Ahead

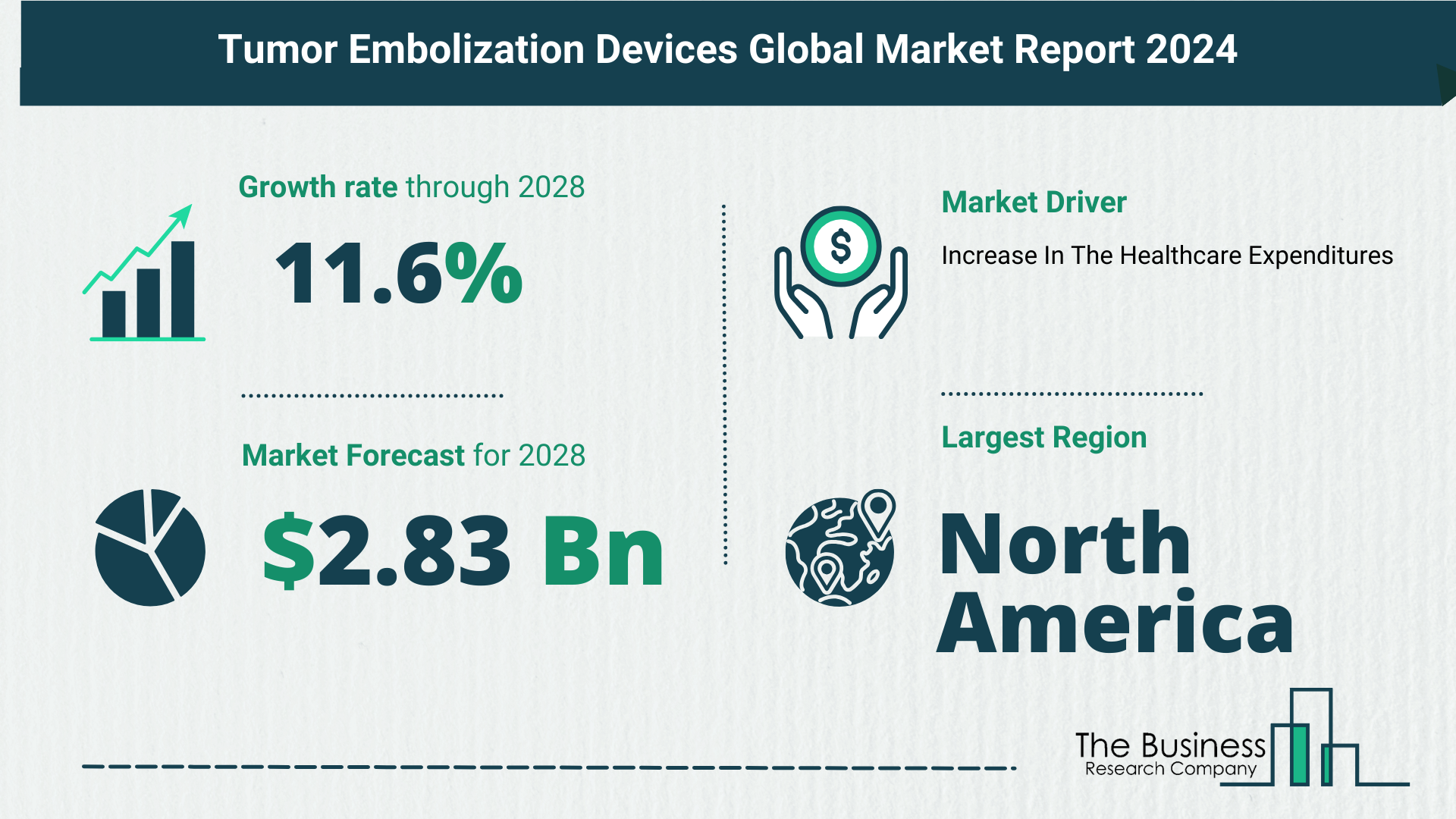

The tumor embolization devices market is poised for continued rapid growth, with an expected escalation to $2.83 billion in 2028, driven by a robust CAGR of 11.6%. The forecasted growth in the coming years is influenced by emerging trends and factors that are reshaping the landscape of cancer treatment.

- Personalized Medicine

- Combination Therapies

- Image-Guided Embolization

- Telemedicine and Remote Consultations

Major Trends: Innovations Reshaping Cancer Treatment*

As the market charts its course, several trends are set to redefine the landscape of tumor embolization devices, reflecting the evolving dynamics of cancer treatment.

- Innovations in Embolic Agents

- Transarterial Chemoembolization (TACE)

- Embolization for Palliative Care

- Image-Guided Procedures

Driving Forces: Increasing Healthcare Expenditures

A key catalyst propelling the growth of the tumor embolization devices market is the significant rise in healthcare expenditures. Increased spending in the healthcare sector contributes to the development and advancement of health-related products, including tumor embolization devices. In the United States, health care spending reached $12,914 per person in 2021, accounting for 18.3% of the country’s GDP, thereby driving the growth of the tumor embolization devices market.

- Impact of Healthcare Expenditures

- Centers for Medicare & Medicaid Services Statistics

Market Giants: Leading the Way in Cancer Treatment

Major companies stand at the forefront, shaping the tumor embolization devices market and steering its trajectory toward unprecedented growth. Industry leaders such as Boston Scientific Corporation, Medtronic PLC, and Terumo Corporation play a pivotal role in defining the market landscape.

- Boston Scientific Corporation

- Medtronic PLC

- Terumo Corporation

- Sirtex Medical Limited

- Merit Medical Systems Inc.

- Cook Medical LLC

- AngioDynamics Inc.

- Siemens Healthineers AG

- Johnson & Johnson

- Hologic

- Surefire Medical Inc.

- Varian Medical Systems Inc.

View More On The Tumor Embolization Devices Market Report 2024 – https://www.thebusinessresearchcompany.com/report/tumor-embolization-devices-global-market-report

Innovative Medication Advancements: Eye90 Microspheres

Companies in the tumor embolization devices market are intensifying their focus on introducing groundbreaking medications. An exemplary case is the Eye90 microspheres, a Y90 radioembolization device designed for the treatment of liver tumors, particularly hepatocellular carcinoma. ABK Biomedical received Investigational Device Exemption (IDE) approval from the US FDA to conduct a pivotal study for Eye90 microspheres, highlighting the commitment to advancing cancer treatment.

- Eye90 Microspheres

- Investigational Device Exemption (IDE)

- ABK Biomedical’s FDA Approval

Strategic Expansion: Boston Scientific Acquires Obsidio Inc.

In a strategic move to bolster its interventional oncology and embolization portfolio, Boston Scientific acquired Obsidio Inc. in August 2022. This acquisition, although undisclosed in amount, positioned Boston Scientific to enhance its capabilities in the tumor embolization devices market.

- Boston Scientific’s Acquisition

- Expansion into Interventional Oncology

- Acquisition of Obsidio Inc.

Market Segmentation: Navigating Diverse Dimensions

Understanding the nuances of the tumor embolization devices market requires a closer look at its segmentation, delineating the diverse facets that contribute to its dynamic nature.

- By Type:

- Radioembolic Agents

- Non-radioactive Embolic Agents

- By Application:

- Cancer Tumors

- Noncancerous Tumors

- By End User:

- Hospitals

- Cancer Treatment Centers

- Intensive Care Units

- Surgical Centers

Regional Dominance: North America Leads the Way

In 2023, North America emerged as the largest region in the tumor embolization devices market, showcasing the region’s prominence in advancing cancer treatment.

- North America Leading in 2023

Request A Sample Of The Global Tumor Embolization Devices Market Report 2024:

https://www.thebusinessresearchcompany.com/sample_request?id=3352&type=smp