Global Orthopedic Prosthetics Market Overview 2024: Size, Drivers, And Trends

The Business Research Company’s global market reports provide comprehensive analysis on the various markets in 27 industries across 60 geographies.

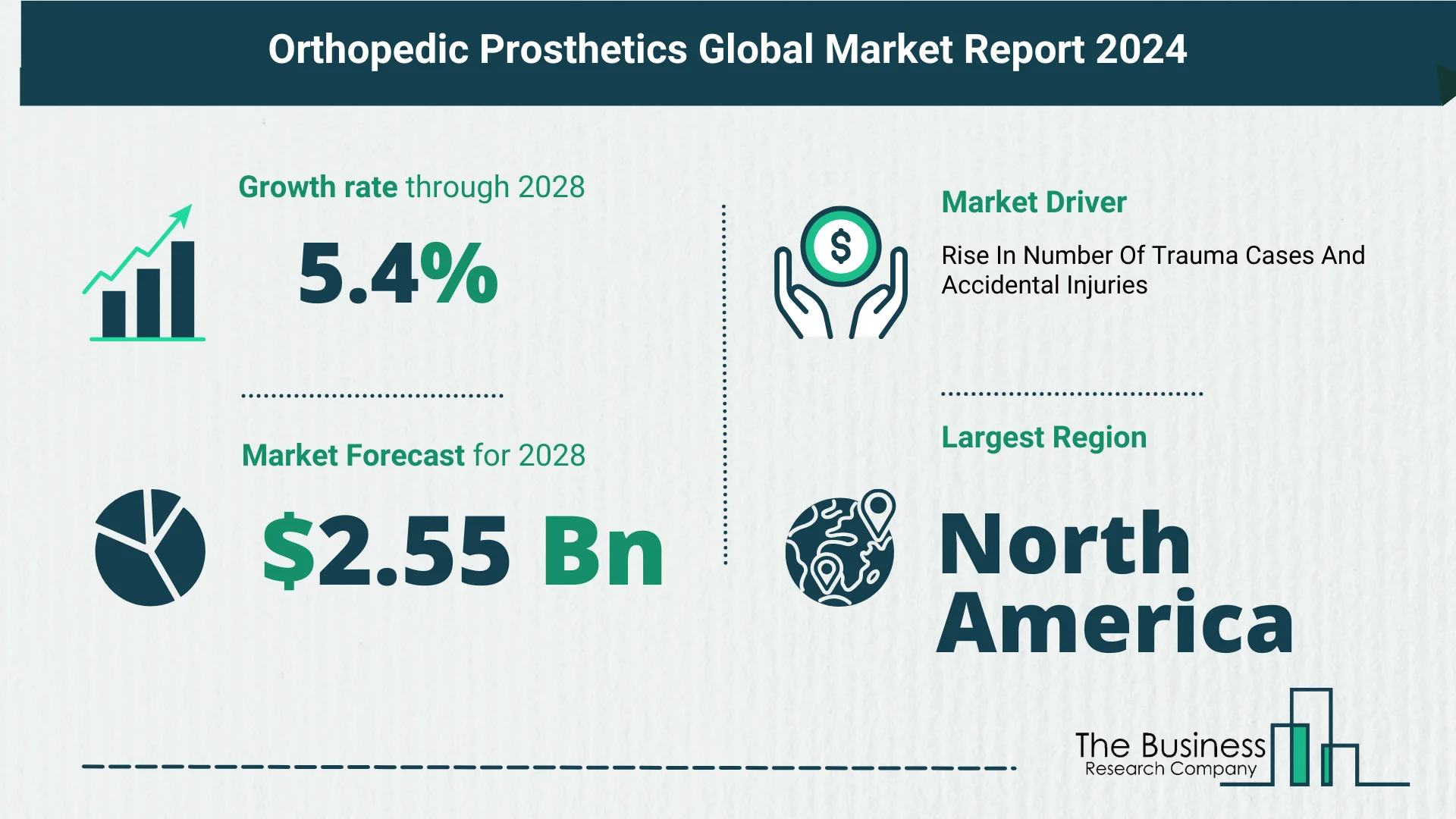

The orthopedic prosthetics market has witnessed robust growth in recent years, with a notable surge from $1.96 billion in 2023 to $2.07 billion in 2024, boasting a Compound Annual Growth Rate (CAGR) of 5.4%. The driving forces behind this growth include factors such as an aging population, trauma and injuries, chronic conditions, and the increasing emphasis on rehabilitation and physical therapy.

Future Outlook

The positive trajectory is expected to persist, projecting a market size of $2.55 billion by 2028, maintaining the 5.4% CAGR. This anticipated growth is attributed to emerging markets, the advent of personalized prosthetic solutions, regulatory support, reimbursement policies, and the adoption of value-based healthcare. Notable trends in the forecast period encompass advanced materials, sensor integration, osseointegration, and user-centered design.

Growing Prevalence of Orthopedic Diseases

Musculoskeletal Disorders on the Rise

The rise in orthopedic prosthetics is intricately linked to the surge in orthopedic diseases affecting the musculoskeletal system. These conditions encompass a spectrum of disorders affecting muscles, bones, nerves, and joints. According to the World Health Organization, an estimated 1.71 billion people worldwide, as of July 2022, suffer from various musculoskeletal conditions, including low back pain, neck pain, fractures, osteoarthritis, and rheumatoid arthritis. Prosthetics play a crucial role in treating and correcting these conditions, driving the growth of the robotic prosthetics market.

Key Players in the Orthopedic Prosthetics Market

Market Dominators

Major companies contributing to the orthopedic prosthetics market include Otto Bock HealthCare GmbH, Blatchford Ltd., Zimmer Biomet Inc., DePuy Synthes, and Stryker Corporation. This expansive list also includes WillowWood, Smith and Nephew PLC, Biomet Inc., Touch Bionics Inc., and many more. The market is populated by a diverse array of organizations, each contributing to the evolution and innovation within the industry.

View More On The Orthopedic Prosthetics Market Report 2024 – https://www.thebusinessresearchcompany.com/report/orthopedic-prosthetics-global-market-report

Specialized Prosthetic Products Launches

Tailored Solutions for Athletes

The market is witnessing a surge in advanced product launches, with a particular focus on specialized prosthetics such as sports prosthetics. Companies like Össur hf. are leading the charge, introducing three new models of its iconic cheetah sports prosthesis. These prosthetic feet are meticulously designed for specific athletic applications, including sprinting, distance running, and long jumping. The cheetah’s implant-agnostic design provides athletes with the flexibility to choose their preferred implant, making it a versatile choice for various athletic settings.

Strategic Acquisition Boosts Solutions

Patient Square Capital’s Move

In October 2022, Patient Square Capital, a prominent US-based healthcare investment firm, made waves by acquiring Hanger Inc. for $18.75 in cash per stock. This strategic move aimed to transform Hanger Inc. into a private entity, enhancing its ability to serve customers and foster continued growth. Hanger Inc., a US-based manufacturer of orthotic and prosthetic patient care services and solutions, stands to benefit significantly from this acquisition.

Market Segmentation

Navigating the Market Landscape

The orthopedic prosthetics market is intricately segmented, providing a nuanced understanding of its dynamics:

- Product Type: The market encompasses Upper Extremity Prosthetics, Lower Extremity Prosthetics, Sockets, and other specialized products.

- Technology: Technological advancements are evident in Conventional orthopedic prosthetics, Electric-powered orthopedic prosthetics, and Hybrid orthopedic prosthetics.

- End Users: The market caters to diverse end users, including Hospitals, Prosthetic Clinics, Rehabilitation Centers, and other specialized facilities.

North America Leads the Way

In 2023, North America emerged as the largest region in the global orthopedic prosthetics market. The region’s dominance underscores the robust advancements, investments, and market penetration achieved in this critical healthcare segment.

In conclusion, the orthopedic prosthetics market continues its upward trajectory, driven by a combination of demographic shifts, technological innovations, and strategic initiatives by key industry players. As we march towards 2028, the landscape promises continued growth, with a focus on addressing the unique needs of individuals and athletes through cutting-edge prosthetic solutions.

Request A Sample Of The Global Orthopedic Prosthetics Market Report 2024:

https://www.thebusinessresearchcompany.com/sample_request?id=2542&type=smp