Overview Of The Orthopedic Braces And Support Devices And Equipment Market 2024: Size, Drivers, And Trends

The Business Research Company’s global market reports are now updated with the latest market sizing information for the year 2024 and forecasted to 2033

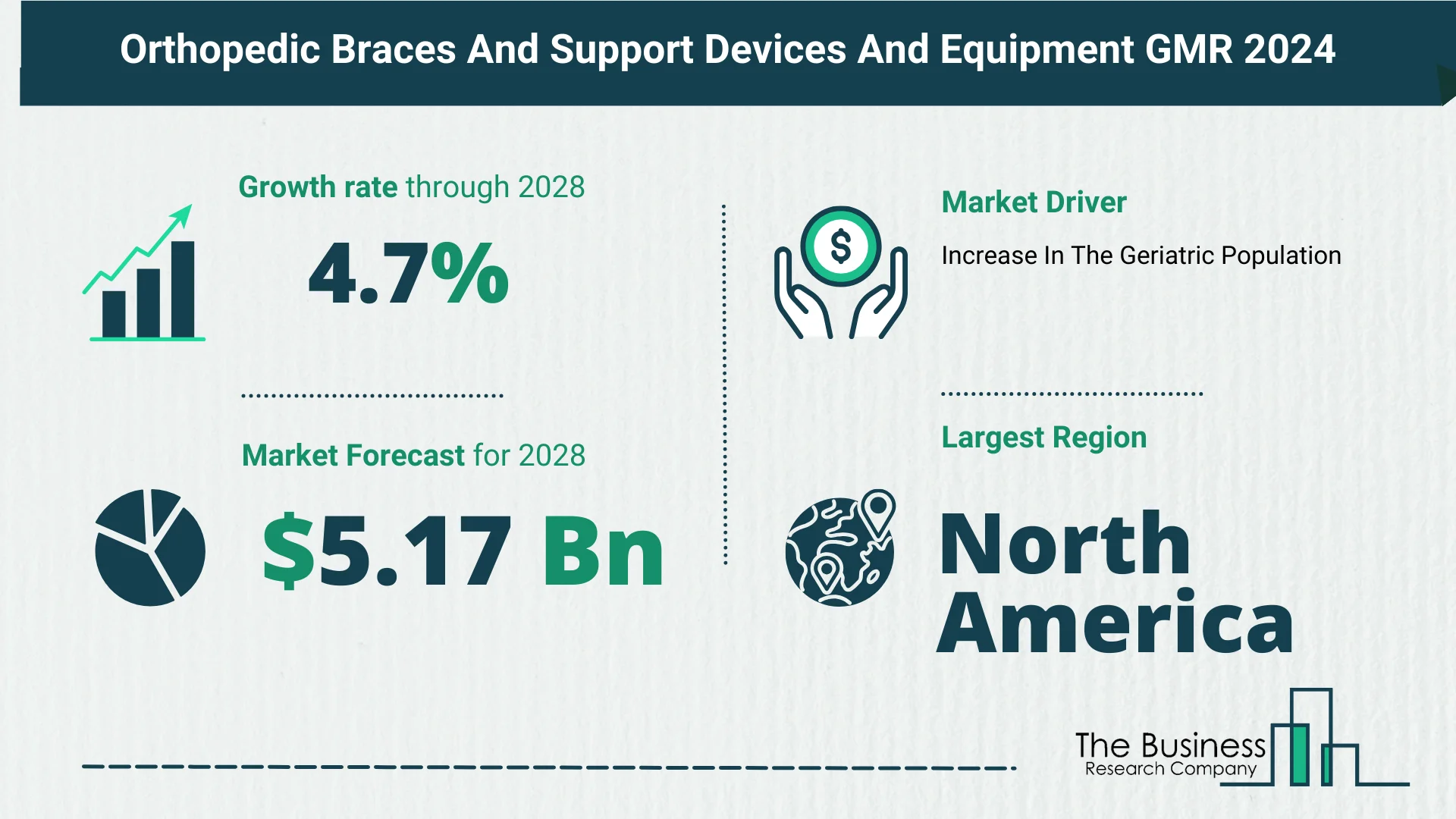

According to The Business Research Company’s Orthopedic Braces And Support Devices And Equipment Global Market Report 2024, the orthopedic braces and support devices and equipment market is expected to show promising growth in the forecast period.

The orthopedic braces and support devices and equipment market have experienced substantial growth, reaching $4.08 billion in 2023. This upward trajectory is set to continue, projecting an increase to $4.31 billion in 2024 at a commendable compound annual growth rate (CAGR) of 5.6%. The historic period’s growth is attributed to various factors, including an aging population, orthopedic injuries, the prominence of rehabilitation and physical therapy, and evolving lifestyle and fitness trends.

Anticipated Steady Growth and Key Drivers

Expectations for steady growth in the orthopedic braces and support devices and equipment market are underscored, with a projected size of $5.17 billion in 2028 at a CAGR of 4.7%. The forecasted expansion is fueled by factors such as growth in emerging markets, regulatory support and reimbursement policies, the advent of value-based healthcare, and the integration of personalized medicine. Notable trends in this period include the emergence of smart orthopedic braces, the utilization of 3D printing, the adoption of lightweight and breathable materials, and the rise of tele-rehabilitation and remote monitoring.

Surging Demand: Escalating Prevalence of Musculoskeletal Disorders

Driving Forces

The surging demand for orthopedic braces and support devices is propelled by the increasing prevalence of musculoskeletal disorders. These disorders affect the musculoskeletal system, leading individuals to seek solutions that manage pain, aid mobility, and enhance recovery. Osteoporosis alone contributes to more than 8.9 million fractures annually, emphasizing the critical need for orthopedic solutions.

Market Impact

- The market is responding to the rising incidence of orthopedic diseases, with companies like DJO Global, Bauerfeind AG, and Otto Bock Healthcare GmbH playing pivotal roles.

- Work-related musculoskeletal disorders have affected an estimated 470,000 workers between 2020 and 2021, indicating a substantial market demand.

View More On The Orthopedic Braces And Support Devices And Equipment Market Report 2024 – https://www.thebusinessresearchcompany.com/report/orthopedic-braces-and-support-devices-and-equipment-global-market-report

Innovative Spine Bracing Products: Advancing Patient Care

Technological Innovations

Major companies in the market are focusing on innovation to enhance patient care, particularly for those with spinal injuries. Innovative spine bracing products have been developed to provide support, stability, and immobilization for spinal conditions, contributing to improved patient outcomes. Breg Inc., for instance, launched pinnacle and ascend, offering enhanced comfort, breathability, and antimicrobial properties.

Product Launch Impact

- Breg Inc.’s new products address common patient complaints about traditional spinal orthoses, showcasing a commitment to patient-centric design and innovation.

- The company now manufactures every major orthopedic bracing category, reinforcing its comprehensive approach to patient care.

Strategic Acquisition: DJO Expands Portfolio with Medshape Inc.

Portfolio Enrichment

In April 2021, DJO, a global leader in braces and support devices, acquired Medshape Inc., a move aimed at enhancing DJO’s portfolio with innovative devices for joint fusion, fracture fixation, and soft tissue injury repair. This strategic acquisition introduces biomaterial technologies designed to improve patient outcomes.

Acquisition Impact

- Medshape Inc.’s expertise in biomaterial technologies aligns with the industry’s focus on improving patient outcomes and introduces a new dimension to DJO’s product offerings.

- The acquisition showcases the industry’s commitment to continuous growth and innovation through strategic partnerships.

Market Segmentation

The orthopedic braces and support devices and equipment market are segmented based on:

- Type:

- Lower extremity braces

- Upper extremity braces

- Back and hip braces

- Other braces

- Product:

- Soft & Elastic Braces and Supports

- Hinged Braces and Supports

- Hard & Rigid Braces and Supports

- End User:

- Hospitals

- Home Healthcare

- Clinics

- Other End-Users

Regional Dominance: North America Leading the Way

North America emerged as the largest region in the global orthopedic devices and equipment market in 2023, signifying its central role in steering market dynamics.

In conclusion, the orthopedic braces and support devices and equipment market continue to evolve, driven by demographic shifts, technological advancements, and a growing focus on personalized patient care. As innovations in smart orthopedic braces, 3D printing, and tele-rehabilitation reshape the landscape, stakeholders can anticipate a future marked by improved solutions for musculoskeletal health and increased patient well-being.

Request A Sample Of The Global Orthopedic Braces And Support Devices And Equipment Market Report 2024:

https://www.thebusinessresearchcompany.com/sample_request?id=2406&type=smp